Carvana stock: The Wild Ride You Didn’t See Coming and Why It Still Matters

Carvana stock : Did you ever see something going down dramatically, only to witness it recover — but in such a way that you can’t really figure it out? That is the saga of carvana stock in the past couple of years. It literally looked like a situation of stock crash followed by stock revival. And now, it’s sort of being at the place where positivism and negativism un-necessarily intermingle.

To me, the story of carvana stock is like a combination of retail and tech walking the stock market’s tightrope.

What is carvana stock

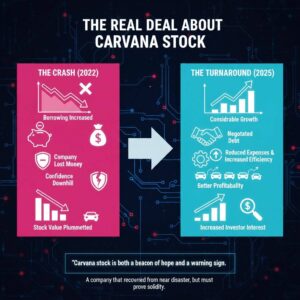

Here’s the truth. Carvana, an online used car sales platform with in-home delivery, went downhill severely in 2022. Borrowing increased immensely. The company lost money. Confidence went downhill. Stock value plummeted.

But the turnaround was to follow. Carvana negotiated debt. Reduced expenses. Increased efficiency. And over 2025, things started to change. The reports speak of considerable growth, soaring unit sales, better profitability, and increased investor interest. Stock Titan+4Fortune+4Investing.com+4

Currently, carvana stock stands for both a beacon of hope and a warning sign — a firm that has managed to recover from near disaster but still has to demonstrate its solidity in the long run.

Why carvana stock Exists / Why People Search It

Carvana stock is a magnet that attracts a lot of attention, which can be explained by several, intertwined factors:

- Seems like a comeback narrative. A resurrection story is what people are most likely to take their pick of — and Carvana’s 2025 results certainly make for a dramatic new chapter.

- It is the epitome of retail disruption. An internet-based used car retailer triumphing in a market that traditional dealerships have found challenging? That surely brings attention.

- It is characteristically unstable — hence exhilarating. The kind of investors who throng to such stocks are the ones looking for quick profits through jumps and dips.

- Many think Carvana has the potential to radically change car buying. If this model succeeds, then it could completely transform the industry.

As far as I’m concerned with market watching, a stock that combines disruption, redemption, and high volatility — becomes very difficult to resist.

Breaking Down What’s Fueling carvana stock — and What’s Holding It Back

1. Strong Sales & Profitability Gains

During 2025, Carvana achieved milestone figures. The number of retail units sold exploded. Revenue jumped. Adjusted EBITDA skyrocketed. Stock Titan+2Investing.com+2 The analysts (such as those at JPMorgan, Jefferies, and Wedbush) were more optimistic about their price targets, referring to a robust recovery and enhanced profitability. Investing.com+3

It’s almost like Carvana is getting rid of the old stuff and starting to run again.

2. A Shift in Consumer Behavior

More and more people are willing to purchase used cars online without going through the hassle of the dealer – no visits to the dealer, no haggling, just browsing and clicking. Carvana’s business model is perfectly in line with this change, and therefore, it may have a long-term advantage over the traditional dealers. Investing.com India+2

It’s not just a trend – it could very well be the new standard.

3. Strong Balance Sheet After Restructuring

It looks like Carvana has managed to pull itself up from the brink of collapse and is in a better position now. According to some analysts, the company’s debt levels are looking more manageable, its liquidity has improved, and its financial fundamentals have strengthened. Investing.com+2 Fortune+2

The change in Carvana’s situation gives investors more confidence in the company – but only if the macro conditions remain stable.

4. High Volatility & External Risks

The thing is, its stock price is still very unstable. In addition, Carvana depends on the continuation of the auto-loan market, interest rates, consumer demand, and other macroeconomic factors. Yahoo Finance+3 Nasdaq+3 MarketBeat+3

Thus, to be sure, the possibility of an increase in stock price is viable – but, at the same time, there is still a chance of the stock price falling.

Also Read : Financecub com Real Facts About : What It Really Is, Why People Look It Up, and What You Should Know

Real-World Parallel: carvana stock Is Like a Renovated Restaurant

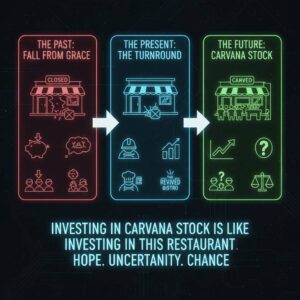

Imagine this:

The restaurant used to be the talk of the town. Afterward, it got out of the control of the management. Customer service was poor. Customers stopped visiting. It almost went out of business.

Finally, new owners did come to the rescue. They did the renovation, improved the food, cut the costs, rebranded the place. Slowly but surely customers started coming back – some were doubtful, others were optimistic.

Investing in carvana stock as of now is similar to investing in the renovated restaurant. There is hope. There is uncertainty. Yet, there is also a genuine chance of success.

Why You Should Care About carvana stock

Even if you have no intention of buying a used car in the near future — carvana stock is still significant for the following reasons:

- It demonstrates how digital transformation can change the face of the already existing industries.

- It points out the concept of post-crisis comeback which can lead to huge returns — but only if the grounding is strong.

- It operates as a risk vs. reward example for volatile stocks.

- It uncovers how the change in consumer behavior (online buying, trust in e-commerce) influences massive sectors such as auto retail.

I used to be an investor, and now I watch investors and find stories such as Carvana’s very enlightening. They shake our preconceived notions that the market is more about numbers than psychology and correct timing.

Real Alternatives / Real Facts

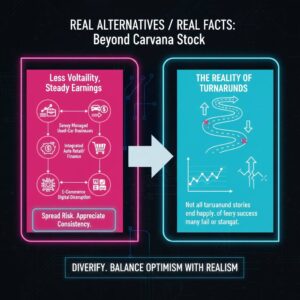

What some of you might not know, if you are fond of the idea behind carvana stock but less volatility, is there a handful of alternatives or facts to choose from:

- Sanely managed used-car businesses suffering a bit from slow growth, but having constant earnings.

- A fully integrated auto retail or auto finance company — less risk, more steady returns.

- Retail business going digital through the E-Commerce companies — if you believe in digital disruption but across different sectors.

- Investment in mutual funds or ETFs — that allow you to spread risk over many companies instead of putting all your eggs in one basket.

Here is one truth: Not all the stories of turnarounds in business end with a happy ending. For each Carvana, there is a company that restructured only to stagnate again. Being diversified is one way of dealing with that risk.

Lessons Behind carvana stock

From watching Carvana’s journey, I’ve learned:

- It really takes a long time for the company to recover and the results are not visible immediately.

- Being ‘the next big thing’ in your story is enough to get you lots of attention — but it is the fundamental that decides the length of your existence.

- Stocks with high volatility can bring you high profits — however, long periods of testing your patience are inevitable.

- The business performance at the internal level is as crucial as the condition of the external market.

- One should never forget to balance up his optimism with realism.

If I were to give advice to my younger self as an investor, I would say: “Don’t follow the hype. Appreciate the consistency. And at the same time, don’t completely shut down the door for potential.”

Also Read : kodomogumi.net-top-stories-trend-analysis: Trend Secrets Nobody Told You

Red Flags to Watch For

Those warning signs are:

- Increasing auto-loan delinquencies

- Poor consumer demand or economic slowdown

- Competition from both conventional dealers and new digital players

- Inventory becoming stagnant or used-car supply increasing

- Cowboy-like reliance on cost-cutting instead of real growth

It’s a good idea to prepare for the worst if you happen to see a cluster of these and volatility may be a problem for you.

Wrapping Up carvana stock

What would be the final assessment of carvana stock?

It’s a rebound narrative. A real one supported by data: record sales, better profitability, positive opinion of analysts. Nevertheless, the company is still walking the tightrope — unsteady, can be affected by external risks and is dependent on consumer trends and general economic stability.

In my opinion, carvana stock is a very interesting case — not because it is going to bring you a safe return, but as it’s a live experiment of retail disruption. It tells what happens when a radical idea collides with harsh market realities.

In case you want to be a part of this story — don’t lose sight of reality. Keep an eye on the fundamentals and be prepared to have both ups and downs.

FAQs About carvana stock

1. Is carvana stock a good investment right now?

It hinges on your risk tolerance. If you can stand the ups and downs and are a long-term believer in Carvana, then the stock might go up. On the other hand, if you like stability — then probably a better idea to invest elsewhere.

2. What are the main reasons behind the ups and downs of carvana stock price?

The main factors are unit sales, earnings (EBITDA, net income), health of the auto-loan market, consumer demand, and general macroeconomic conditions.

3. Can Carvana completely replace traditional car dealerships?

Maybe — after a certain period of time. However, it is heavily reliant on company performance, consumer trust, and whether the company can scale operations in a sustainable way.

4. What are the major risks of Carvana’s business model?

The most significant threats credit-market stress, rising delinquencies, an over-supply of used cars, and economic recessions.

5. Would it be better for me to diversify my investment portfolio rather than invest all my money in carvana stock?

Certainly, diversification works as a cushion against risk. You may want to consider holding stable retailers, broad indexes, or different sectors instead of putting all your money into one stock which is highly volatile.