News Block

Fullwidth Featured

Is QQQ ETF a Good Investment? A Realistic Look at Growth, Risk, and Long-Term Potential

People usually don’t ask “Is QQQ ETF a good investment?” casually.They ask it after seeing QQQ outperform the broader market and wondering: “Am I missing out by not investing in this?” This article is not here to hype QQQ.It’s here to explain what QQQ really is, who it’s for, and who should stay away. What […]

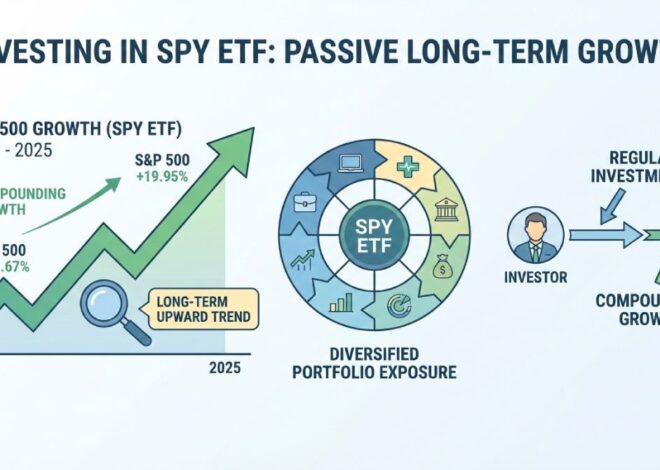

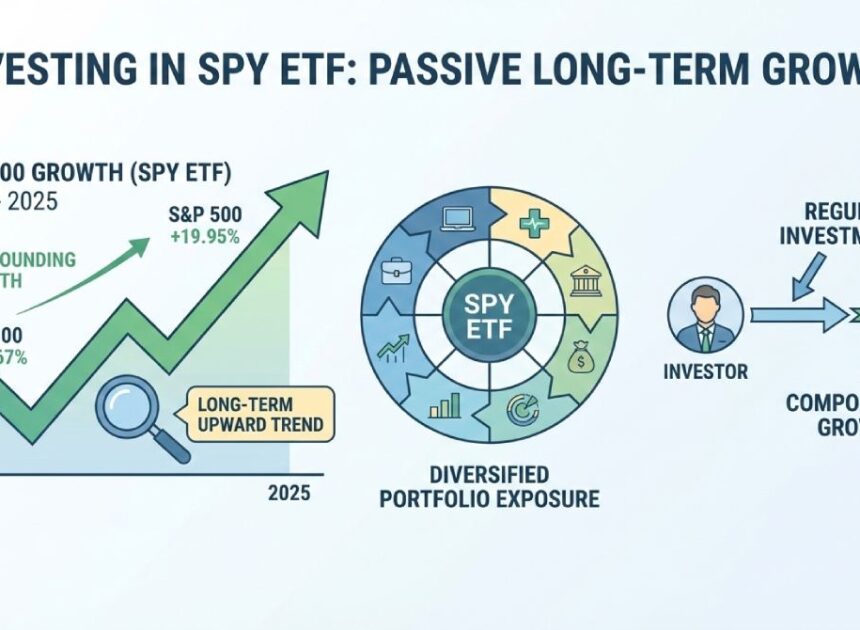

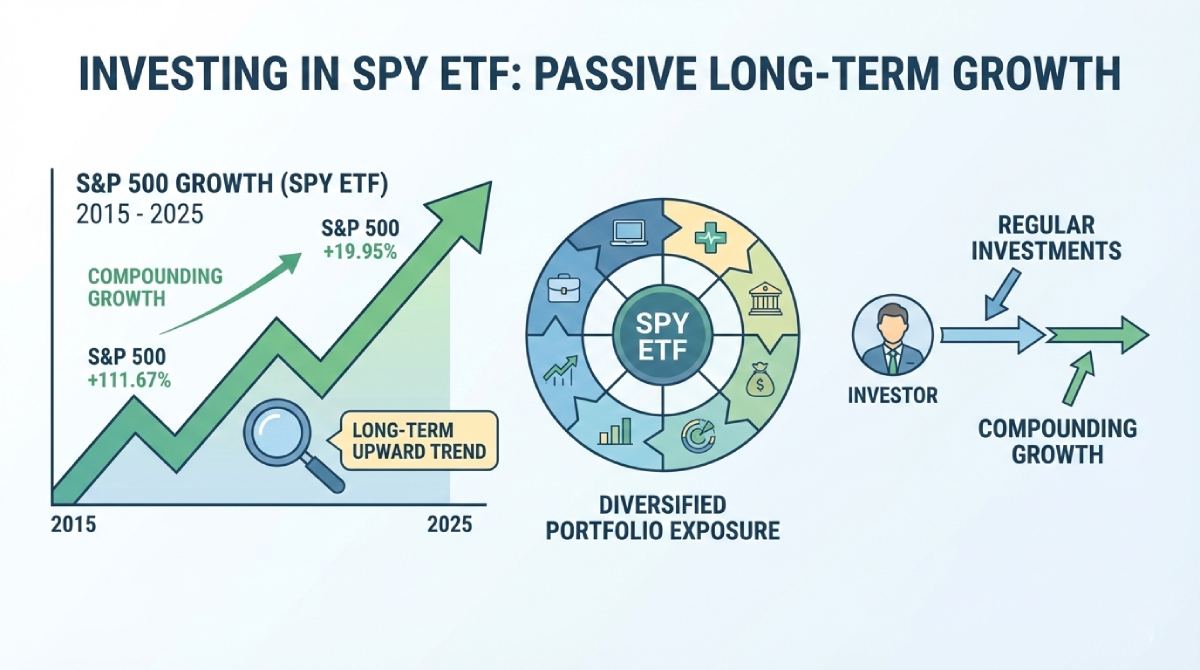

Is SPY ETF a Good Investment? A Clear, No-Hype Breakdown for Long-Term Investors

A lot of investors already invest in something like SPY…They just don’t realize SPY exists. When people ask “Is SPY ETF a good investment?”, what they’re really asking is: “Can I grow my money steadily without constantly picking stocks?” This article answers that honestly. What Is the SPY ETF? (Simple Explanation) SPY is an exchange-traded […]

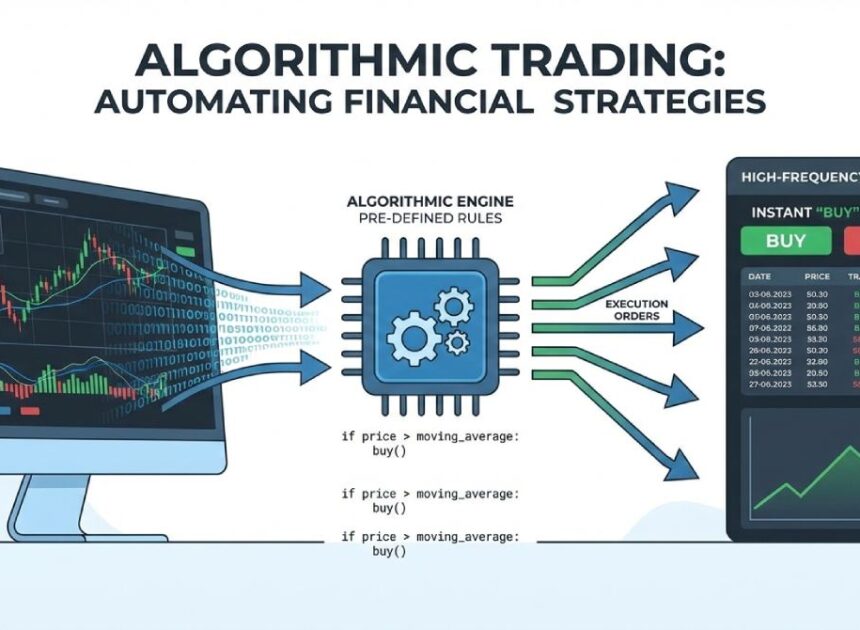

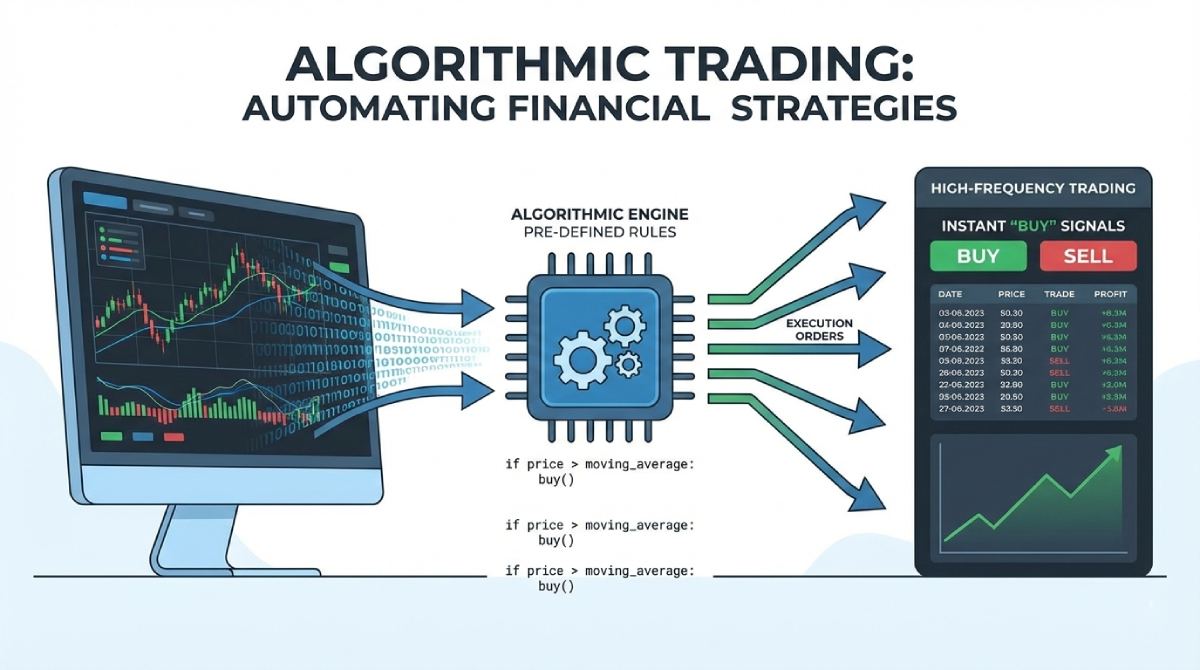

Algorithmic Trading Explained: How Automated Trading Really Works

Algorithmic trading is a technology-driven approach under types of trading, where trades are executed automatically based on predefined rules rather than manual decisions. Algorithmic trading sounds intimidating. Lines of code. Complex systems. Big institutions.So when people search for algorithmic trading, they’re usually trying to answer one question: “Is this something only professionals can do, or […]

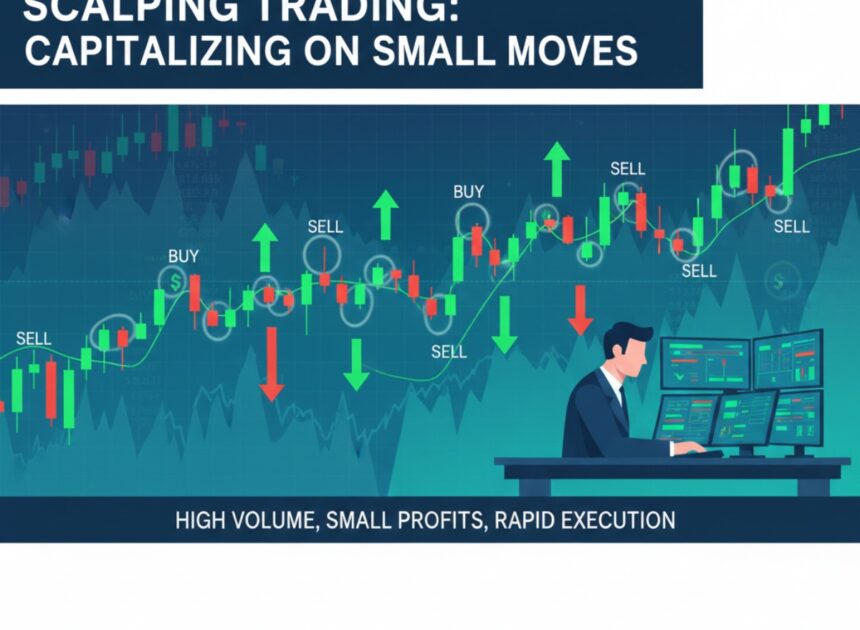

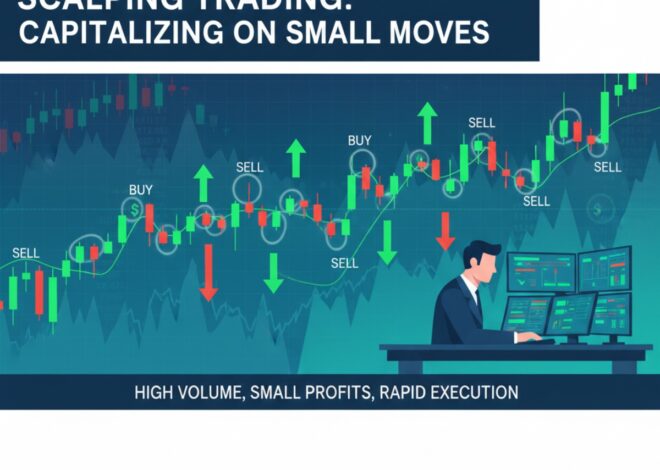

Scalping Trading Explained: How Traders Make Small Profits in Minutes

Scalping looks exciting from the outside. Fast trades. Quick profits. Constant action. Scalping trading is one of the fastest approaches under types of trading, focusing on frequent, short-duration trades rather than long holding periods. But most people search for scalping trading only after realizing how mentally exhausting it actually is. This article explains scalping trading […]

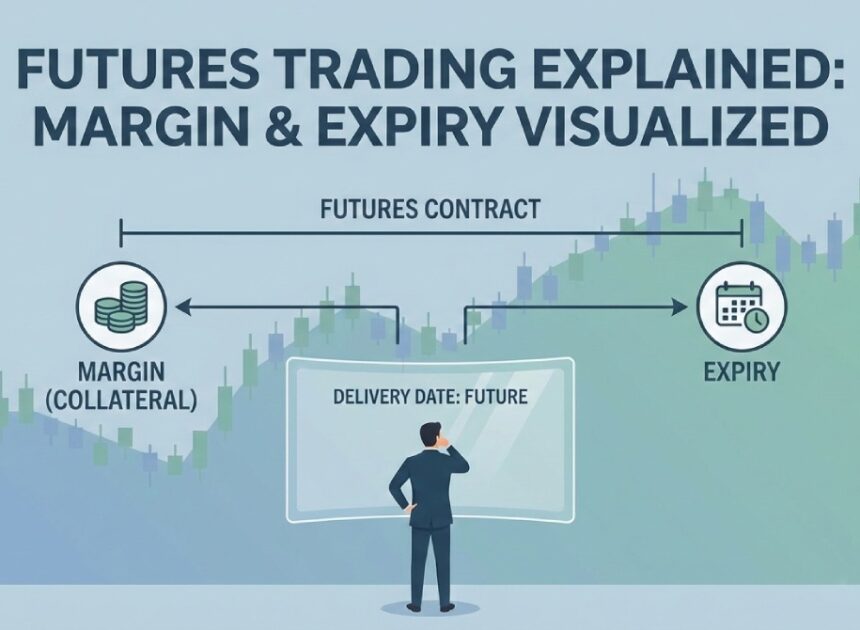

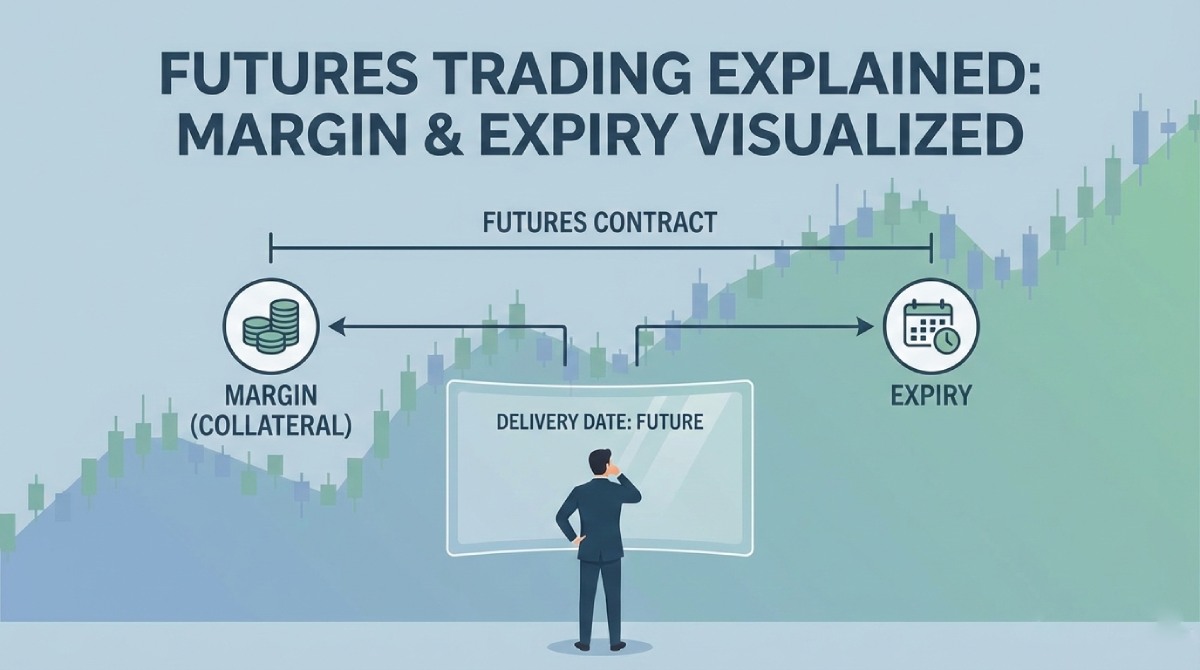

Futures Trading Explained: How Contracts, Margin, and Risk Really Work

Futures trading is often spoken about casually, but very few people actually understand what they’re trading. Many jump in because they hear about leverage, margins, or quick profits. Then they search for futures trading only after things go wrong. Futures trading is one of the more advanced approaches under types of trading, where traders deal with […]

Options Trading Explained: How Calls, Puts, and Risk Really Work

Most beginners search for options trading because nobody breaks it down calmly. It’s either too technical or too promotional. Options trading is one of the most misunderstood things in the stock market. This is one of the more advanced approaches under types of trading, involving contracts rather than direct ownership of shares.Some people think it’s easy money. […]