Oracle Stock: What’s Happening Now, Why It Matters, and Where It Could Be Headed

Oracle stock : Had you ever a glance at a stock headline and thought to yourself, “Hold on, what just happened?” That has been the feeling concerning the Oracle stock. It seems that the company is on a very cloud growth and AI hype rally one day, and only the following day you hear news of a quick drop due to low earnings and a worried atmosphere among investors. A suspense movie is what it is like in this case, where the plot twists come one after another and ending guesses are thrown out by everyone.

In that case, let us decide and take our time outlining everything in a human, understandable, and conversational manner. No matter which of the three roles – long-term investor, trader, or just curious about Oracle’s stock story – you take, this article will help you decipher the noise.

What is Oracle Stock

Oracle stock is, in fact, the stock of Oracle corporation (NYSE: ORCL), which is one of the largest global technology companies, highly recognized for doing business with databases, software for enterprises, and, very soon, mainly with cloud infrastructure services. Its stock is not simply a number on a screen; rather, it is the market’s way of showing how well investors think Oracle will be performing in the future.

However, the latest signal they are sending is a rather mixed one.

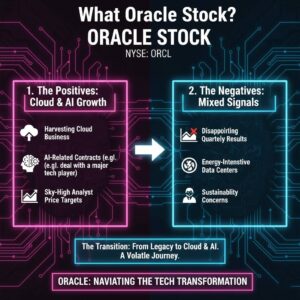

The most positive thing about Oracle is that it is harvesting fruits of its cloud business and AI-related contracts such as a deal with a major tech player. Consequently, some analyst price targets have been extended toward the sky — a few reaching extreme scenarios for the long run — as investors take positions betting on the rapid scope of cloud and AI infrastructure expansion.

Yet, it takes a turn for the worse. For example, the company has produced quarterly results that disappointed the market expectations recently, and hence its stock has had to retreat from the recent peaks. Some investors who take the sustainability issue seriously are quite put off by such things as the company’s plans to pile up data centers with technology equipment that requires a lot of energy in the cooling process.

As far tech stocks are concerned, I would say that a typical situation of such transition from legacy products to the new era of cloud and AI technologies, would be that company is not going to have a very stable journey. Oracle seems to be in such a transition stage.

Why It Exists / Why People Search Oracle Stock

Querying a stock is related to one or multiple of the following intentions:

- Investors need the freshest price or fundamental data.

- Traders focus on the patterns and the momentum.

- Oracle becomes a topic of interest because AI is the mainstream buzz.

- People comes across financial news and their interest is sparked.

- Long-term holders take a glance at their portfolio.

It is hard for me not to be intrigued by the fact that a company, which was once a leader in enterprise databases, is now transforming into one of the major players in the AI infrastructure field. The coming of that change naturally implies more search queries.

Breaking Down Oracle Stock: What’s Driving It

1. Cloud and AI Momentum

Oracle’s cloud business is, at the moment, what most people focus on when they talk about its growth. That is the main reason why the company mood is optimistic, as it is being pushed by deals with large enterprise clients and a strong revenue backlog. When Oracle addresses AI-powered infrastructure, investors cannot help but pay attention. That is a clear signal of the departure of the company from mature licensing towards cloud services which are considered as the future.

That particular transition is indeed the largest lever pushing interest in Oracle stock these days.

2. Analyst Upgrades and Price Targets

Analyst ratings are something that many investors take into consideration. It normally attracts a lot of investor attention and when large firms, amongst which we have Oracle, raise their price target to bullish numbers it is generally understood as a signal of their trust in the long-term horizon of the company. But still, the opinion of the analysts is not unanimous – there is a small group of analysts being extremely optimistic and a small group of them being cautious.

The disagreement on this point keeps traders arguing and investors monitoring for the next earnings announcement.

3. Earnings Info: The Pros and Cons

The latest earnings of Oracle have caused excitement and uncertainty simultaneously. There were some quarters that showed good profits and others that disappointed with revenues lower than expected or with softer guidance. The movement in earnings of the company often causes significant changes in the stock price.

Such an oscillation is typical for companies that are undergoing pivotal transformational stages.

4. Financial Strategy and Heavy Investment

Oracle is spending billions on new data centers, AI infrastructure, and cloud capacity. This may be a big win in the future. But, currently, the case is that some investors express concern over cash flow, debt situation, and heavy capital expenditure.

This debate between taking the side of investment and that of profitability is the main reason behind the volatility of Oracle stock.

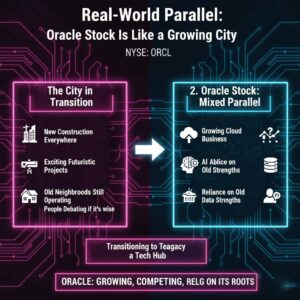

Real-World Parallel: Oracle Stock Is Like a Growing City

Think of a city that did very well producing for a while — and now is in a hurry to become a world-famous tech center. What you would find are:

- New construction everywhere

- Exciting futuristic projects

- Old neighborhoods still operating

- People debating whether the transition is wise

Oracle stock is the same. It is growing, changing, and trying to compete with the leaders in cloud and AI while at the same time relying on its old strengths.

Why You Should Care

The matter of the company is still important for you if you are not buying the stock of Oracle because:

- The case of AI is showing how old companies can transform in the new era.

- It is a barometer of tech innovation market psychology.

- Cloud and AI are shaping the future of business.

- Changes of Oracle affecting rival companies in tech industry

As far as I am concerned, tracking companies that are going through changes is an eye-opening experience as to the vast market trends and long-term investment opportunities.

Real Alternatives / Real Facts

For example, if you want a stock that is similar to Oracle in the field of enterprise technology or AI infrastructure, you may consider one of the following companies:

- Microsoft

- Amazon

- IBM

- VMware

Real fact: Oracle stock has experienced dramatic changes in value over the last couple of weeks, with fast upward movements as well as related declines after earnings, analyst reactions, and announcements about cloud business and large investments.

Quite the opposite of being a quiet slow mover, this is a stock where knowing the story is key to understanding its ups and downs.

Lessons Behind It

The stock of Oracle teaches these lessons to the audience:

1. Hype doesn’t guarantee stability

While ai buzz generates very much excitement, it is still the fundamentals that determine the outcome.

2. Big growth entails big investment

Massive spending will lead to business growth later on but will also test the patience of investors.

3. Change transitions are almost never smooth

The move from legacy to cloud tech is by nature uncertain.

4. Analysts affect sentiment — but hardly ever concur

5. Time is necessary for successful reinvention

In my viewpoint, the ones that make it are those companies which manage to keep innovating while at the same time being financially disciplined.

Red Flags to Watch For

If you are an Oracle stock holder or a potential buyer, it is wise that you take note of the following:

- Increasing debt levels

- Slower cloud revenue growth

- Dependence on a few major contracts

- Profit warnings

- Unexpected changes in market sentiment

At any moment, these can be the reasons for the stock turning in a totally different direction.

Wrapping Up Oracle Stock

Oracle stock is no more just about the power of its databases. In fact, it is currently under a massive transformation where it is turning itself to be a leading cloud and AI infrastructure provider. With this, there is both risk and reward, and as a result, the stock keeps fluctuating.

At this point in time, the story of Oracle is that of a mixture of innovation, hefty spending, bullishness, and unpredictable swings in stock price. It might be a company worth looking at for those investors who are into long-term bets on transformation. In my experience, these are the sorts of companies that most often end up surprising the market — and sometimes quite dramatically.

FAQs About Oracle Stock

1. Is Oracle stock a good long-term investment?

Depending on the risk tolerance, yes. With potential in cloud and AI, but volatility in the short term.

2. Why has Oracle stock been volatile recently?

The main reasons are the fluctuation in earnings, the heavy investment-related spending, and the changing investor sentiment.

3. What is driving Oracle’s recent momentum?

It’s mainly due to cloud infrastructure, AI workloads, and enterprise partnerships that are strategic in nature.

4. What do analysts think about Oracle stock?

Quite a number of them have a positive view of the company and have raised price targets but opinions are not always aligned.

5. What risks should investors consider?

Possible risk factors could be debt levels, cloud competition, pressure on earnings, and high spending.