Stock Market: The Real Guide People Should’ve Told You Earlier

Let’s be honest.

The stock market sounds scary until you actually understand it. Once you do, it feels almost… obvious. Old concept. Time-tested. Still powerful.

I’ve noticed one thing over the years: people fear what they don’t break down. So let’s break this down properly. No hype. No fake promises. Just how the stock market really works and why it still matters.

What Is the Stock Market

At its core, the stock market is a system where ownership of companies is bought and sold.

Nothing fancy.

Companies raise money.

Investors provide capital.

Both sides benefit if things go right.

That’s the deal. Always has been.

Stock Market Meaning (Simple Words)

In simple words, the stock market is a marketplace for businesses.

Instead of selling fruits or phones, it sells company ownership.

These ownership units are called shares or stocks.

When you buy a stock, you’re not betting.

You’re becoming a part-owner. Even if it’s tiny.

I find it interesting how this basic idea still confuses people, even though it’s been around for centuries.

Why the Stock Market Exists

The stock market exists for one reason: growth funding.

Companies need money to:

-

Expand

-

Build factories

-

Hire talent

-

Enter new markets

Banks alone can’t fund everything. So companies sell equity to the public.

On the flip side, investors want their money to grow faster than inflation.

This is where the stock market meets real life.

Role of Stock Market in the Economy

The stock market isn’t just about investors making money.

It:

-

Fuels business expansion

-

Creates jobs

-

Encourages innovation

-

Reflects economic confidence

When markets rise steadily, it usually means businesses are growing.

When markets fall hard, something’s broken underneath.

That’s why governments, central banks, and media track it obsessively.

How the Stock Market Works

This is where clarity matters.

Primary Market Explained

The primary market is where shares are created.

When a company launches an IPO, it sells shares directly to investors.

Money goes to the company, not to another investor.

Simple flow:

Company → Investors → Capital raised

Secondary Market Explained

This is where most people operate.

Here, investors trade shares among themselves.

The company is not involved.

Price moves based on:

-

Demand

-

Supply

-

Expectations

This is what you see daily on trading apps.

How Shares Are Bought and Sold

Shares are bought and sold via brokers.

Earlier, it was phone calls and paperwork.

Now it’s apps and clicks.

But the logic hasn’t changed:

-

Buyer wants ownership

-

Seller wants exit

-

Exchange matches both

Old system. Modern interface.

Role of Stock Exchanges

Stock exchanges provide structure and trust.

In India, the major ones are NSE and BSE.

They ensure:

-

Fair pricing

-

Transparency

-

Liquidity

-

Regulation compliance

Without exchanges, markets would be chaos.

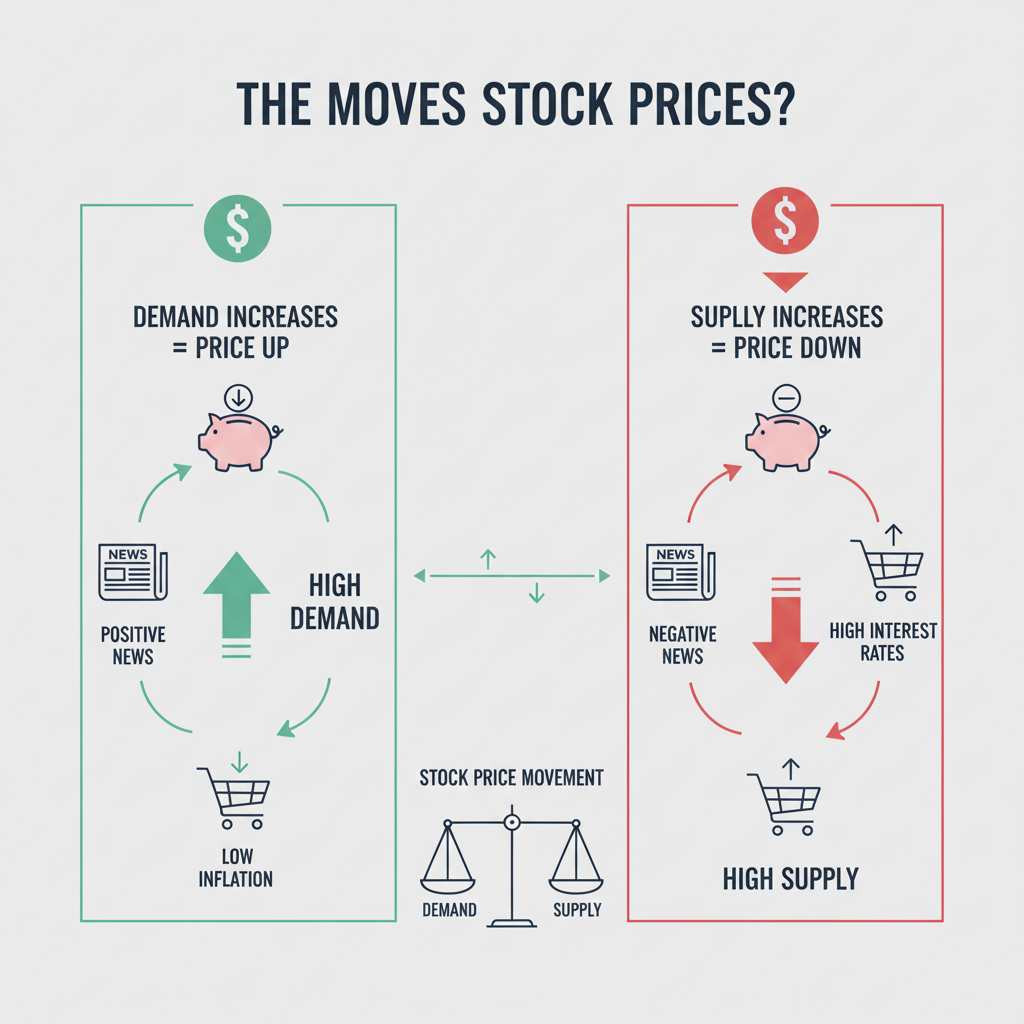

Why Stock Market Goes Up or Down

This is where emotions meet economics.

Demand and Supply Basics

More buyers than sellers → prices rise

More sellers than buyers → prices fall

That’s it. Everything else is noise.

Impact of News & Events

Markets hate uncertainty.

Things that move markets:

-

Elections

-

Wars

-

Budget announcements

-

Corporate earnings

-

Policy changes

Sometimes logic wins. Sometimes panic does.

Interest Rates Effect

Higher interest rates:

-

Make loans expensive

-

Slow business growth

-

Push investors toward fixed returns

Lower rates do the opposite.

This relationship is old-school economics. Still undefeated.

Inflation Impact

Inflation eats purchasing power.

When inflation rises:

-

Costs increase

-

Profits shrink

-

Valuations adjust

That’s why markets react fast to inflation data.

Market Sentiment Explained

This is the human part.

Fear. Greed. Hope. Panic.

From my experience, sentiment moves markets short term, but fundamentals decide the long term.

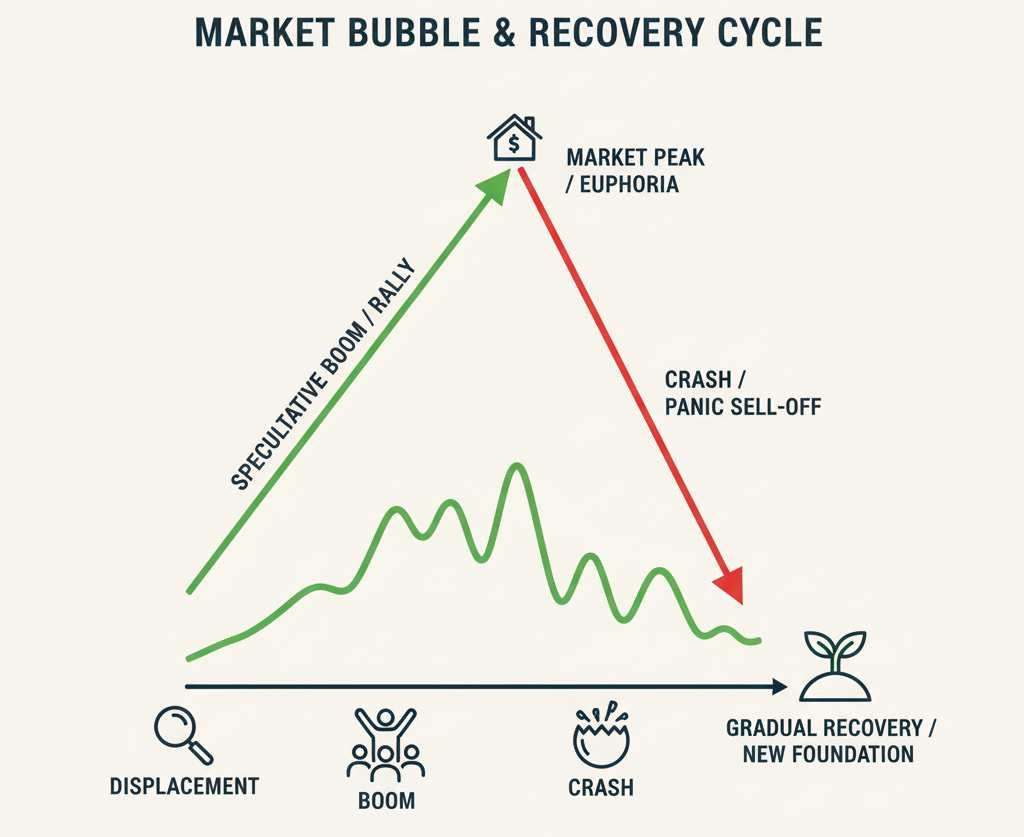

Stock Market Crashes & Bubbles

What Is a Stock Market Crash

A crash is a sudden, sharp fall in prices.

Usually caused by:

-

Panic selling

-

Systemic risks

-

Financial bubbles bursting

Crashes feel dramatic. But they’re not new.

What Is a Stock Market Bubble

A bubble forms when prices rise far beyond reality.

Everyone buys because prices are rising.

Nobody checks fundamentals.

Eventually, reality shows up.

And the bubble pops.

Correction vs Crash

Correction:

-

10–15% fall

-

Normal

-

Healthy

Crash:

-

30%+ fall

-

Fast

-

Emotion-driven

Big difference. Many beginners confuse the two.

Bear Market Explained

A bear market is prolonged pessimism.

Prices fall. Confidence drops.

Media screams doom.

Ironically, this is where long-term wealth is quietly built.

How Markets Recover

Markets recover because:

-

Businesses adapt

-

Innovation continues

-

Economies evolve

Every major crash in history eventually recovered.

That pattern hasn’t broken yet.

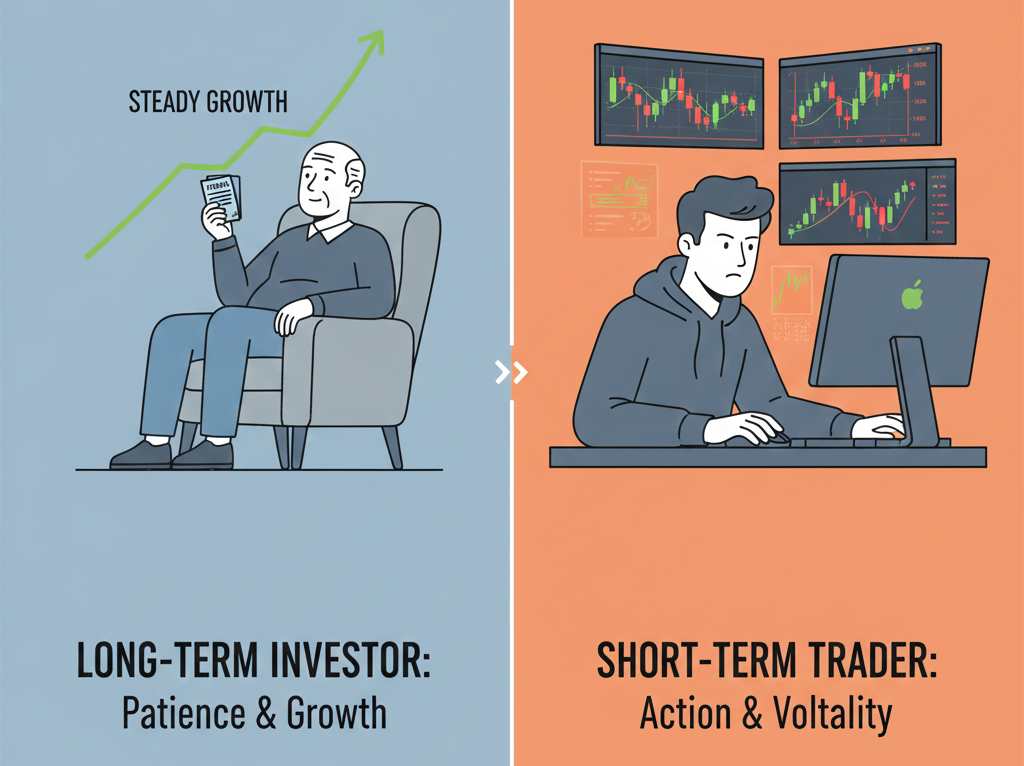

Investing vs Trading

This is where most people mess up.

Long-Term Investing Explained

Investing is boring. And that’s the point.

You:

-

Buy good businesses

-

Hold through cycles

-

Let compounding work

Slow. Steady. Proven.

Short-Term Trading Explained

Trading focuses on:

-

Price movements

-

Timing

-

Technical patterns

It demands:

-

Skill

-

Discipline

-

Emotional control

Most beginners underestimate this.

Risks of Trading vs Investing

Trading risks:

-

Overtrading

-

Emotional losses

-

Capital erosion

Investing risks:

-

Poor stock selection

-

Patience shortage

From what I’ve seen, impatience kills more portfolios than bad stocks.

Common Beginner Mistakes

-

Chasing hot tips

-

Ignoring risk management

-

Overconfidence

-

No exit plan

Hard truth: the market charges a fee for ignorance.

Stock Market Participants

Retail Investors Role

Retail investors are individuals like you and me.

Earlier, they were sidelined.

Now, they move markets too.

Institutional Investors Role

Institutions bring:

-

Large capital

-

Stability

-

Research depth

Their moves often set trends.

FIIs and DIIs Explained

FIIs: Foreign Institutional Investors

DIIs: Domestic Institutional Investors

They influence liquidity and sentiment, especially in emerging markets.

Market Makers Explained

Market makers provide liquidity.

They ensure you can buy or sell without wild price gaps.

Invisible, but crucial.

Promoters Impact on Stock Prices

Promoters’ actions matter.

Buying signals confidence.

Selling raises eyebrows.

Smart investors track promoter behavior closely.

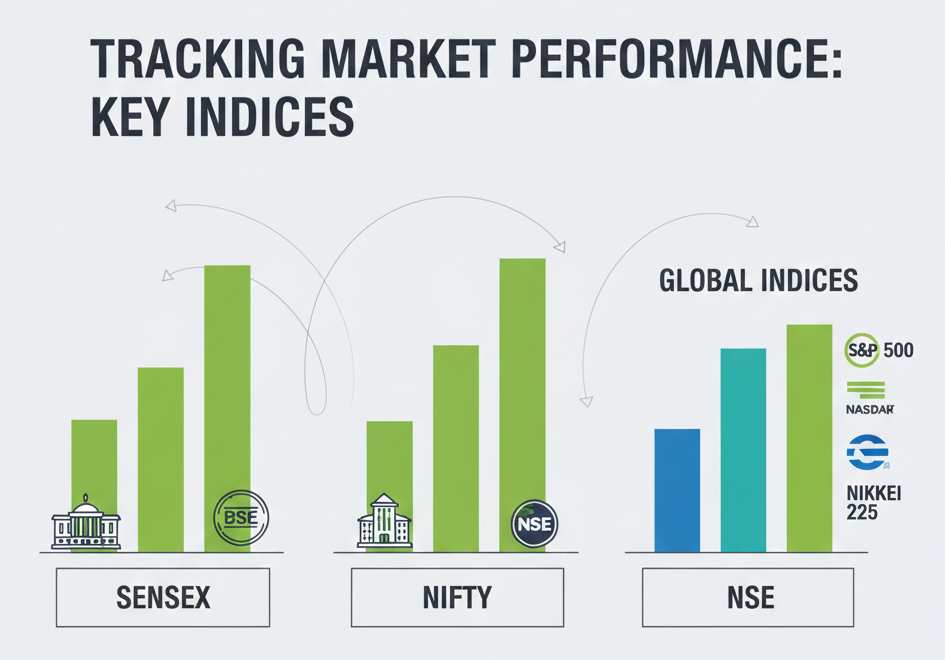

Stock Market Indices & Benchmarks

What Is a Stock Market Index

An index tracks a group of stocks.

It reflects overall market health.

Why Indices Exist

Indices:

-

Simplify performance tracking

-

Enable comparisons

-

Power index funds

They’re the market’s report card.

Sensex vs Nifty

In India:

-

Sensex tracks 30 stocks

-

Nifty 50 tracks 50 stocks

Both are benchmarks. Neither predicts your portfolio.

Dow Jones Explained

Globally, Dow Jones tracks major US companies.

Old index. Still influential.

Total Stock Market Index

This tracks entire market exposure, not just large firms.

Great for long-term, low-effort investing.

Index Rebalancing Explained

Indices rebalance periodically.

Underperformers exit.

Strong companies enter.

It keeps indices relevant.

Market Timing & Calendars

Is Stock Market Open Today

Markets follow strict calendars.

Holidays, weekends, and special events matter.

Market Hours Explained

In India:

-

Open: Morning

-

Close: Afternoon

Exact timings matter for traders, not investors.

Stock Market Holidays

Holidays pause trading.

But news still flows.

Gaps can happen next session.

Pre-Market and Post-Market

These sessions indicate sentiment.

Useful for clues.

Not gospel.

What Happens When Market Is Closed

Orders queue up.

Global cues build.

Next session absorbs it all.

Regulation, Safety & Trust

Is Stock Market Safe

Safe? Yes.

Risk-free? No.

That’s the honest answer.

Who Regulates Stock Market

Regulation ensures fairness and transparency.

Role of SEBI

In India, SEBI oversees the market.

It:

-

Protects investors

-

Regulates intermediaries

-

Prevents fraud

Not perfect. But essential.

How Investors Are Protected

-

Disclosure norms

-

Audit requirements

-

Trading surveillance

Systems exist. But vigilance is still personal responsibility.

Stock Market Scams Explained

Scams thrive on:

-

Greed

-

Lack of knowledge

-

Urgency

Same story every time.

How to Avoid Stock Market Frauds

-

Avoid guaranteed returns

-

Verify sources

-

Stick to regulated platforms

If it sounds too good, it usually is.

Stock Market Basics for Beginners

Common Stock Market Terms

-

Equity

-

Market cap

-

Dividend

-

Volatility

-

Liquidity

Learn the language. It matters.

Simple Stock Market Example

You buy a solid company.

You hold it for years.

Earnings grow.

Price follows.

That’s the game.

How Beginners Should Start

-

Learn basics

-

Start small

-

Prefer index funds

-

Focus on consistency

Flashy strategies come later.

Mistakes Beginners Must Avoid

-

Overtrading

-

Blind tips

-

Emotional decisions

-

Ignoring risk

Patience beats excitement.

FAQs

1. Is the stock market risky for beginners?

Yes, if you rush. No, if you learn and stay disciplined.

2. Can I start the stock market with small money?

Absolutely. Consistency matters more than capital size.

3. Is long-term investing better than trading?

For most people, yes. History supports it.

4. Do stock markets always recover after crashes?

Historically, yes. Time heals markets.

5. Who should avoid the stock market?

Anyone looking for guaranteed returns or quick riches.

Final Thought

The stock market isn’t magic.

It’s a mirror of human behavior and business reality.

Respect it. Learn it.

And it rewards patience like few other systems ever have.