Algorithmic Trading Explained: How Automated Trading Really Works

Algorithmic trading is a technology-driven approach under types of trading, where trades are executed automatically based on predefined rules rather than manual decisions. Algorithmic trading sounds intimidating. Lines of code. Complex systems. Big institutions.

So when people search for algorithmic trading, they’re usually trying to answer one question:

“Is this something only professionals can do, or can normal traders understand it too?”

This article explains algorithmic trading calmly — no buzzwords, no overpromises. Just how it actually works.

What Is Algorithmic Trading? (Algorithmic Trading Explained Simply)

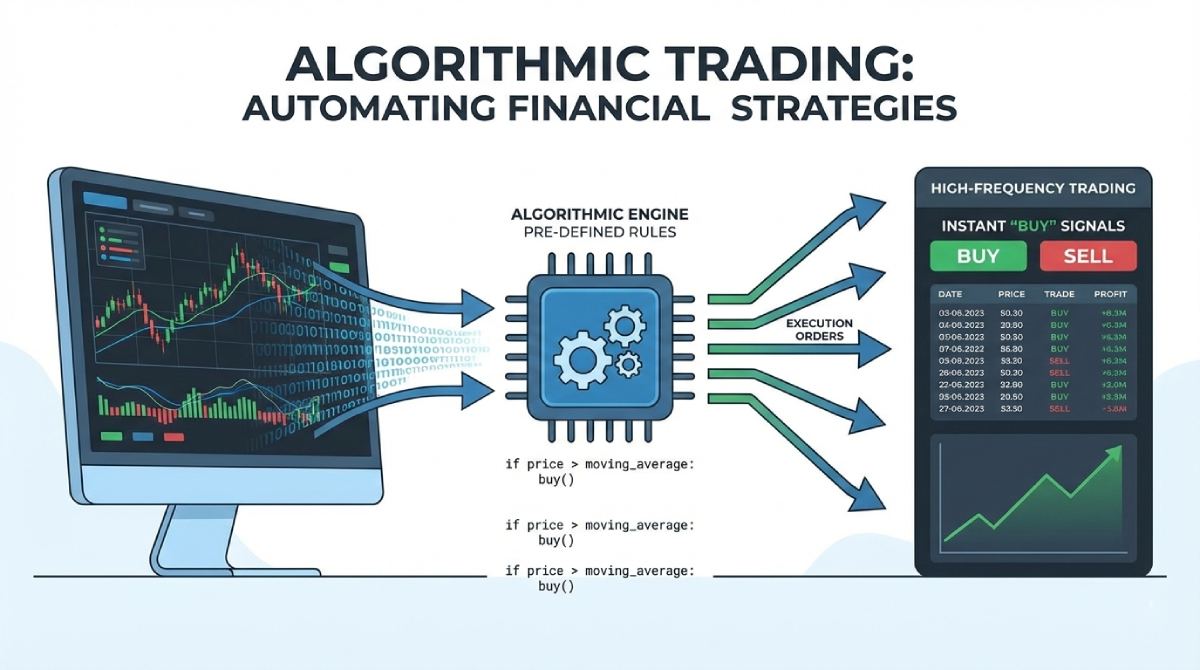

Algorithmic trading means using computer programs (algorithms) to execute trades automatically based on predefined rules.

These rules can include:

-

Price

-

Time

-

Volume

-

Technical indicators

Once set, the system executes trades without manual intervention.

I find it interesting how people assume algorithmic trading removes human involvement completely. In reality, humans design the rules — machines just execute them.

If I had to explain it in one line:

Algorithmic trading uses automated systems to place trades based on predefined logic instead of manual decisions.

Where Algorithmic Trading Fits in Types of Trading

Algorithmic trading falls under the broader types of trading, but it’s different from other styles.

It’s not defined by:

-

Holding period

-

Market direction

-

Speed alone

Instead, it’s defined by execution method.

From my experience, algorithmic trading is less about predicting markets and more about removing emotional errors.

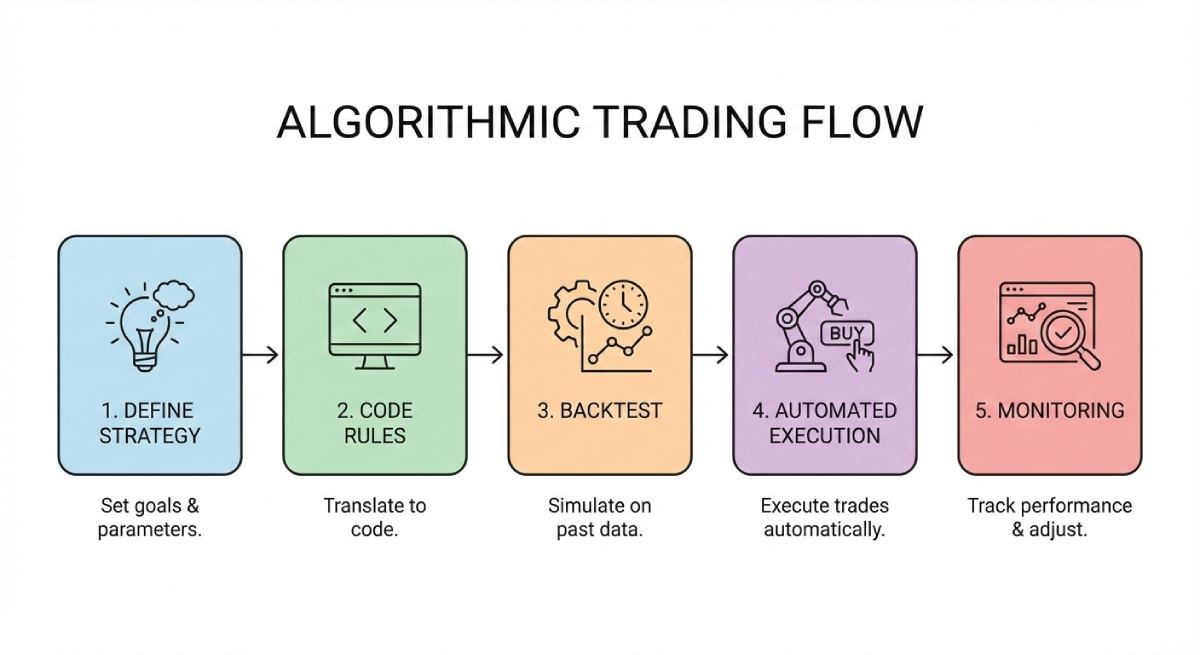

How Algorithmic Trading Works (Step-by-Step)

Step 1: Define the strategy

Every algorithm starts with logic:

-

Entry conditions

-

Exit conditions

-

Risk limits

The strategy can be simple or complex.

Step 2: Convert rules into code

These rules are translated into:

-

Programming logic

-

Automated instructions

Once coded, the system follows rules strictly.

Step 3: Backtesting

Before live use:

-

Strategy is tested on past data

-

Performance and risks are evaluated

From my experience, skipping backtesting is one of the biggest mistakes.

Step 4: Live execution

Once deployed:

-

Trades are placed automatically

-

Emotions are removed

-

Speed and accuracy improve

Step 5: Monitoring and adjustments

Even automated systems need:

-

Regular monitoring

-

Updates when market conditions change

Algorithms are tools, not magic boxes.

Algorithmic Trading vs Intraday Trading

This comparison matters.

Algorithmic trading

-

Rule-based execution

-

Emotionless

-

Requires setup and testing

-

Manual decisions

-

Emotion-driven

-

Requires constant attention

I’ve noticed many intraday traders move to algorithmic trading to reduce emotional stress.

Algorithmic Trading vs Scalping Trading

These are often confused.

Algorithmic trading

-

Can be slow or fast

-

Depends on strategy design

Scalping trading

-

Always fast

-

Always manual (for most retail traders)

From my experience, algorithmic trading can execute scalping-style strategies more consistently than humans.

Benefits of Algorithmic Trading

Key advantages include:

-

Faster execution

-

Reduced emotional bias

-

Consistent rule-following

-

Ability to handle multiple markets

I find it interesting how discipline becomes programmable in algorithmic trading.

Risks in Algorithmic Trading

Let’s be realistic.

Algorithmic trading has risks:

-

Coding errors

-

Over-optimization

-

Market condition changes

-

Technical failures

Understanding algorithmic trading explained properly means knowing that automation amplifies both strengths and weaknesses.

Capital Requirements for Algorithmic Trading

You don’t need massive capital, but you do need:

-

Stable systems

-

Reliable internet

-

Proper risk limits

From my experience, poor infrastructure ruins good strategies faster than bad logic.

Is Algorithmic Trading Good for Beginners?

Honest answer: Not immediately.

Beginners should first:

-

Understand market basics

-

Learn manual trading discipline

-

Then automate proven logic

I’ve seen beginners fail not because algorithms are hard, but because they skipped foundational learning.

Common Misconceptions About Algorithmic Trading

Let’s clear some myths:

-

“Algorithms guarantee profits” → False

-

“No losses happen” → False

-

“Only institutions can do it” → Also false

Algorithmic trading is powerful, but not effortless.

Personal Observations (Real Talk)

From my experience:

-

Algorithms expose weak strategies quickly

-

Discipline beats complexity

-

Simpler systems survive longer

I’ve noticed traders who treat algorithmic trading as a process — not a shortcut — perform better long-term.

FAQs: Algorithmic Trading Explained

-

What is algorithmic trading in simple words?

Automated trading using predefined rules. -

Is algorithmic trading legal?

Yes, when broker and exchange rules are followed. -

Can retail traders do algorithmic trading?

Yes, with the right tools and knowledge. -

Does algorithmic trading remove emotions completely?

It removes execution emotions, not design bias. -

Is coding mandatory for algorithmic trading?

Helpful, but not always mandatory. -

Is algorithmic trading risky?

Yes, if poorly designed or unmanaged. -

Can algorithmic trading work in all markets?

No, strategies depend on market conditions. -

How long does it take to learn algorithmic trading?

Several months with consistent learning.

Final Thoughts

If you were searching for algorithmic trading explained, here’s the truth:

-

It’s systematic

-

It’s disciplined

-

It’s unforgiving to poor logic

Algorithmic trading doesn’t replace thinking.

It replaces hesitation.