Duolingo Stock Plunges Despite 45% Revenue Growth — Here’s Why Investors Reacted

My first reaction to the Duolingo stock update was a little like when Duo owl suddenly arrives after you miss a lesson. You think everything is going great, then you get shocked by a surprise. Duolingo actually posted strong revenue this quarter. Nevertheless, they lost a lot of money when their stock took a big hit due to the change in future bookings forecast they shared. It was puzzling at first, but once I looked deeper into the figures, the narrative was much clearer. So, let’s figure it out as two friends would do discussing the latest news during a walk or at the café.

Why Duolingo Stock Is Suddenly Trending Again

Duolingo threw a big surprise to investors with a sharp increase in revenue. The company’s top line grew 45% year-over-year to $167.6 million which was 2 million dollars more than the Wall Street estimate of roughly $165 million. As an everyday user, I can tell you that this news just confirms the trend. Pretty much everyone I know is using Duolingo to learn Korean, Spanish, or even High Valyrian for fun.

However, even with that robust revenue figure, the market chose to ignore it and focus on something else. The company’s bookings increased just by 18% to $197.5 million which was below the analyst’s estimate of around $203 million. Since bookings are a sign of the business that will come in the future, the softer forecast immediately landed in the shadow of the revenue success. Consequently, duolingo stock went down by approximately 16–20% in after-hours trading.

It is really surprising how things were turned around so rapidly, almost like losing your streak after you have kept it for 100 days.

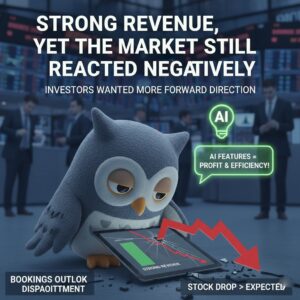

Strong Revenue, Yet the Market Still Reacted Negatively

Even if Duolingo had a strong quarter, it seemed like investors wanted to see more, especially in the forward direction. Very much dependent on future bookings is investor confidence. And the quarter’s figures were far from expectations.

Nevertheless, there was one positive point. Duolingo communicated that its AI-powered features are on the profit side. Products such as Explain My Answer, Smart Review, and newest AI-driven lesson paths are not only making the company more efficient but also lessening the human content creation requirement by up to 50%, thus margin is increased. Actually, I am a fan of these new AI features. They seem more natural and give me the opportunity to fix my mistakes quicker.

But there was a major focus on the bookings outlook by the market despite the huge improvement made. The reason the stock drop was stronger than expected was therefore that.

User Growth Is Rising, but Spending Patterns Shifted

Duolingo also reported an enormous expansion of its user base. Monthly active users grew by 46%. Daily active users rose by 54%. And paid subscribers increased by 54%, reaching 7.2 million. These figures are gigantic. It perfectly corresponds to what I have been noticing on social media, where everyone is talking about their Duolingo streaks nowadays.

However, the catch is here. Even though the number of users is going up, the average bookings per user has slightly decreased. This has made investors anxious about how quickly Duolingo can convert its massive audience into paying users going forward. And once again, this doubt has contributed to the downward movement of the duolingo stock.

Why the Drop Happened So Fast

Revenue is the current indicator. Bookings are the future indicator. Investors are more concerned about the future than the present. Therefore, only the cautious forecast was enough to disrupt the momentum of the great work that Duolingo has done.

It is analogous to telling a friend, “I studied well today,” and then, “I might take a break next week.” What they finally hear is only the break. That is how the market has treated Duolingo this week.

Is This Drop a Big Problem? Not Really.

Yes, there was a sudden drop of duolingo stock, but the main long-term story is still intact and looks very promising. The number of users is on a rapid rise. Revenue is still increasing. AI features are bringing in profits. Besides, the company remains the leader in the global language-learning market.

It is true that the bookings forecast was a bit dull. But a forecast is just that, and companies can always make adjustments. Duolingo is still one of the most innovative and creative companies in the ed-tech industry, and its future growth trajectory looks quite stable.

I am more concerned with my streak, though. However, as a tech enthusiast, I will definitely watch how Duolingo will handle its growth in the coming quarters. The likelihood of the stock rebounding is quite high if the company is able to give a strong bookings outlook.

At the moment, it is just another interesting addition to the ongoing story of a platform we all know—and occasionally fear when we miss a lesson.

Also Read:- OpenAI News Today: The Shocking Rise of 1 Million+ Business Users