Equity Trading Explained: A Clear Guide to the Cash Market

Most people think equity trading is complicated because it’s usually explained in complicated ways. Big words. Fancy charts. Too much noise. But when you strip it down, equity trading is actually one of the simplest and most logical ways to participate in the stock market.

That’s why so many beginners search for equity trading explained—they want clarity, not jargon.

If you’ve ever felt confused about what equity trading really is, how it works, or whether it’s right for you, this guide is meant to feel like a calm conversation, not a lecture.

What Is Equity Trading? (Equity Trading Explained Simply)

Let’s not overthink this.

Equity trading means buying and selling shares of companies in the stock market.

That’s it.

When you trade equities:

-

You are trading ownership units of a company

-

You participate in price movement based on demand, supply, and business performance

I find it interesting how people mix up equity trading with derivatives or options. Equity trading is actually the foundation on which all other trading instruments are built.

If someone asked me for equity trading explained in one sentence, I’d say:

👉 It’s the buying and selling of company shares in the stock market.

Where Equity Trading Fits in Markets & Instruments

Since this is a cluster article, placement matters.

Under Markets & Instruments, equity trading sits in the cash market category. It’s the most direct and transparent form of market participation.

Here’s how it connects:

-

Equity trading → direct share ownership

-

Derivatives trading → contracts based on shares

-

Index trading → baskets of equities

-

Options & futures → derivatives of equities

From my experience, understanding equity trading first makes everything else easier to grasp later.

How Equity Trading Works (Step-by-Step)

Let’s walk through the actual flow, without theory overload.

Step 1: Choosing a stock

You select a listed company whose shares are actively traded.

This decision can be based on:

-

Fundamentals

-

Technical levels

-

Market trends

Beginners often rush here. I’ve seen this many times. The stock selection matters, but understanding the process matters more.

Step 2: Placing a trade

You place a buy or sell order through your trading platform.

In equity trading:

-

You trade at market price or limit price

-

Orders are matched on the exchange

Step 3: Price movement

Prices move due to:

-

News

-

Earnings

-

Market sentiment

-

Supply and demand

This is where patience starts getting tested.

Step 4: Exit

You exit when:

-

Your target is achieved

-

Your stop-loss is hit

-

Your view changes

That’s the core workflow of equity trading explained practically.

Equity Trading vs Derivatives Trading

This comparison clears a lot of confusion.

Equity trading

-

Involves actual shares

-

Lower leverage

-

Lower complexity

-

More beginner-friendly

Derivatives trading

-

Based on contracts

-

Uses leverage

-

Higher risk

-

Requires deeper understanding

From my observation, many beginners jump into derivatives too early. Equity trading gives you the space to learn without constant pressure.

Equity Trading vs Index Trading

Another common question.

Equity trading:

-

Focuses on individual companies

-

Higher reward potential

-

Requires stock selection skill

Index trading:

-

Tracks a group of stocks

-

More stable

-

Less stock-specific risk

I find it interesting that people who struggle with stock selection often feel more comfortable with index-based approaches later.

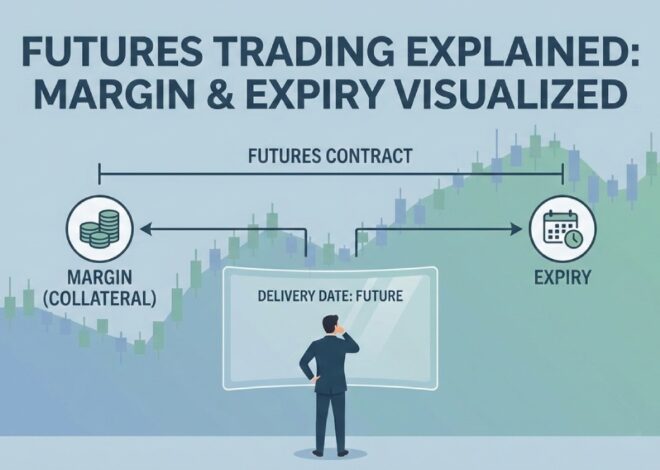

Equity Trading in the Cash Market

Equity trading happens in the cash market, meaning:

-

Trades are settled with actual shares

-

Ownership changes hands

-

No expiry dates

This is very different from derivatives markets where contracts expire.

From my experience, understanding cash market mechanics builds confidence and discipline.

Delivery Trading vs Equity Trading

This confusion shows up a lot.

Here’s the truth:

-

Delivery trading is a type of equity trading

-

Delivery simply means you hold shares beyond one day

So whether you:

-

Trade intraday

-

Hold for a few days

-

Hold long term

You’re still participating in equity trading.

Risk in Equity Trading (What People Don’t Talk About)

Let’s be honest.

Equity trading is not risk-free.

Risks include:

-

Price volatility

-

Wrong stock selection

-

Emotional decisions

But compared to leveraged instruments, equity trading gives you more control and breathing room.

From my experience, risk in equity trading is manageable if you:

-

Use stop-loss

-

Control position size

-

Avoid overtrading

Capital Requirements for Equity Trading

You don’t need huge capital to start.

What you do need:

-

Realistic expectations

-

Discipline

-

Patience

Equity trading rewards consistency, not aggression.

I’ve noticed traders with smaller capital often perform better early because they are careful.

Common Mistakes in Equity Trading

Let’s call these out clearly.

Beginners usually:

-

Chase hot stocks

-

Ignore risk management

-

Overtrade

-

Hold losers too long

I find it interesting how people blame the market when the real issue is behavior.

Understanding equity trading explained properly helps avoid these mistakes early.

Is Equity Trading Good for Beginners?

Short answer: Yes.

Long answer:

-

It’s simpler than derivatives

-

Less stressful than intraday for many

-

Teaches market basics well

From my experience, equity trading is the best starting point before exploring advanced instruments.

Personal Observations (Straight Talk)

From my experience:

-

Equity trading teaches patience

-

It exposes emotional habits

-

It builds real market understanding

I’ve seen traders jump instruments, but the ones who truly understand equity trading usually last longer in markets.

It’s the base layer. Ignore it, and everything else feels harder.

FAQs: Equity Trading Explained

1. Is equity trading safe?

It carries risk, but it’s safer than leveraged trading if managed properly.

2. Can beginners start with equity trading?

Yes. It’s often the best place to start.

3. Do I need large capital for equity trading?

No. Start small and scale gradually.

4. Is equity trading same as delivery trading?

Delivery trading is one form of equity trading.

5. Can equity trading be done daily?

Yes, both intraday and short-term trades fall under equity trading.

6. Is equity trading better than derivatives?

For beginners, usually yes.

7. How much time does equity trading need?

Less screen time compared to intraday trading.

8. Can equity trading generate long-term wealth?

Yes, if combined with patience and discipline.

Final Thoughts

If you were searching for equity trading explained without confusion, here’s the takeaway:

-

It’s the most direct way to trade markets

-

It’s simpler than most people think

-

It builds strong foundations

Learn equity trading properly first.

Everything else becomes easier after that.