Futures Trading Explained: How Contracts, Margin, and Risk Really Work

Futures trading is often spoken about casually, but very few people actually understand what they’re trading. Many jump in because they hear about leverage, margins, or quick profits. Then they search for futures trading only after things go wrong. Futures trading is one of the more advanced approaches under types of trading, where traders deal with contracts that lock prices for future transactions rather than owning assets directly.

This guide is written to explain futures trading calmly, without hype, and without assuming prior knowledge. Think of this as the explanation you should read before placing your first futures trade.

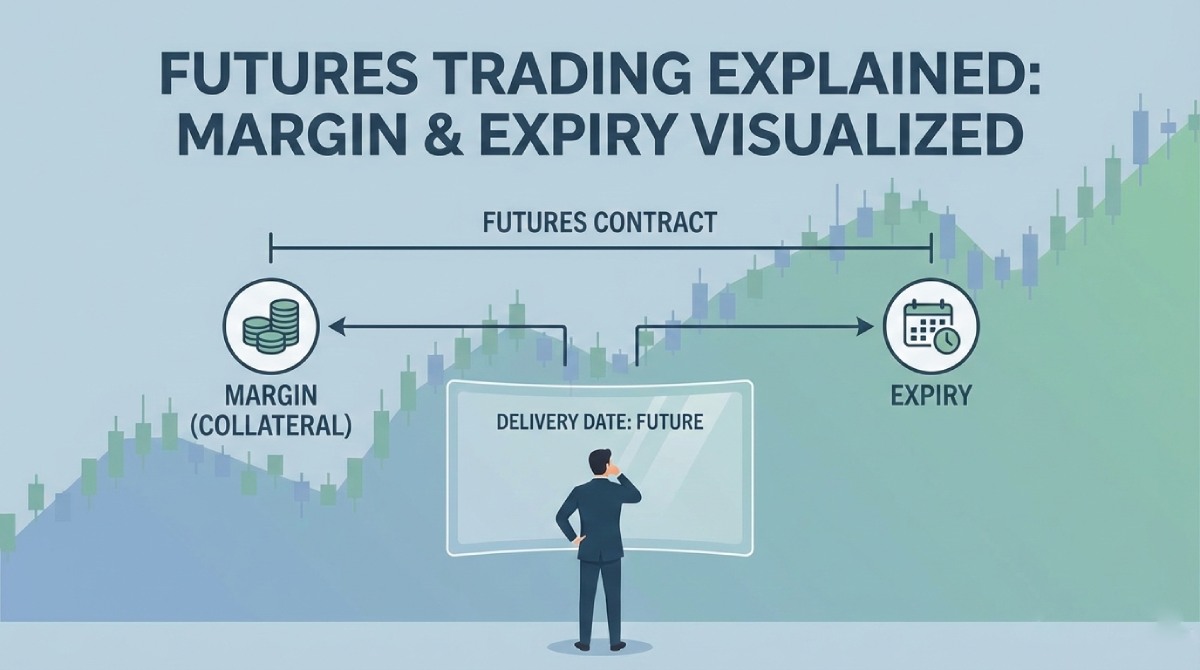

What Is Futures Trading? (Futures Trading Explained Simply)

At its core, futures trading is about trading a contract, not an asset.

A futures contract is an agreement:

-

To buy or sell an asset

-

At a fixed price

-

On a fixed future date

The key thing to understand is this:

You are committing to a transaction in the future, even though you trade the contract today.

I find it interesting how many beginners assume futures trading is just another form of buying stocks. It’s not. It’s a completely different mechanism.

If I had to explain futures trading in one line, it would be:

Futures trading is the buying and selling of contracts that lock in a price for a future transaction.

Where Futures Trading Fits in Types of Trading

Futures trading is part of the broader types of trading, but it behaves very differently from equity-based trading styles.

Unlike delivery or intraday trading:

-

Futures use leverage

-

Futures have expiry dates

-

Futures require margin maintenance

From my experience, this is where most confusion starts. Traders underestimate the commitment involved in futures contracts.

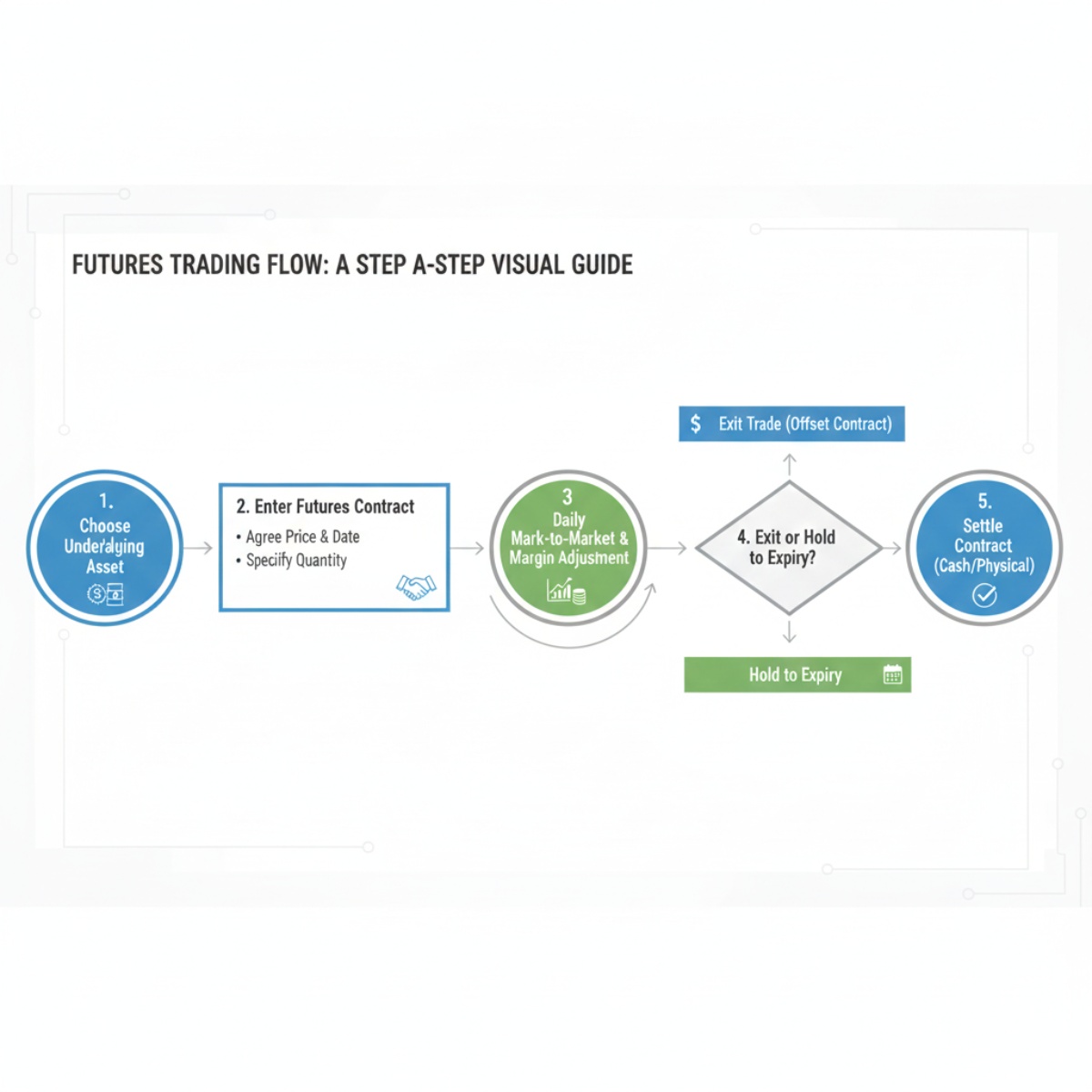

How Futures Trading Works (Step-by-Step)

Let’s break this down in a simple flow.

Step 1: Choose the underlying asset

Futures contracts are available on:

-

Indices

-

Stocks

-

Commodities

You are not trading the asset itself. You are trading a contract derived from it.

Step 2: Enter a futures contract

When you buy or sell a futures contract:

-

You agree to transact at a future date

-

You deposit margin, not full value

This margin is only a fraction of the total contract value, which creates leverage.

Step 3: Daily mark-to-market

This is one of the most important concepts.

Futures positions are:

-

Adjusted daily

-

Profits and losses settled each day

From my experience, many beginners don’t expect daily settlement and panic when margins fluctuate.

Step 4: Holding or exiting

You can:

-

Exit the position before expiry

-

Roll over to the next contract

-

Hold till expiry (rare for most traders)

Most traders close positions before expiry.

Step 5: Expiry or rollover

On expiry:

-

Contracts settle

-

New contracts replace old ones

This expiry cycle is a defining feature of futures trading.

Futures Trading vs Options Trading

Unlike options trading, where traders have a right without obligation, futures trading involves a binding agreement that must be honored unless the position is exited earlier. This comparison is important because both are derivatives.

Futures trading

-

Obligation to buy or sell

-

Linear profit and loss

-

Margin-based

Options trading

-

Right, not obligation

-

Non-linear payoff

-

Premium-based

I’ve noticed traders often move to futures after understanding options, not the other way around.

Margin and Leverage in Futures Trading

Leverage is the biggest attraction — and the biggest danger.

In futures trading:

-

Small price moves = big P&L changes

-

Losses can exceed initial margin

From my experience, futures trading punishes poor risk control faster than most trading styles.

Risk in Futures Trading (Don’t Ignore This)

Let’s be honest.

Futures trading is high-risk if not managed properly.

Key risks include:

-

High leverage

-

Overnight gaps

-

Margin calls

-

Emotional decision-making

Understanding futures trading explained properly means accepting that capital protection matters more than profit chasing.

Capital Requirements for Futures Trading

You don’t need the full contract value, but you do need:

-

Adequate margin buffer

-

Ability to handle drawdowns

-

Emotional discipline

I’ve seen traders with small capital survive longer than large accounts simply because they respected leverage.

Common Mistakes in Futures Trading

These mistakes show up repeatedly:

-

Over-leveraging positions

-

Ignoring margin requirements

-

Holding till expiry unknowingly

-

Treating futures like intraday stocks

I find it interesting how futures trading failures usually come from misunderstanding obligations, not market direction.

Is Futures Trading Good for Beginners?

Honest answer: Not immediately.

Beginners should:

-

First understand equity trading

-

Learn risk management

-

Approach futures with caution

From my experience, futures trading rewards preparation, not speed.

Personal Observations (Hard Truth)

From my experience:

-

Futures trading magnifies discipline issues

-

Small mistakes grow quickly

-

Patience and planning matter more than intelligence

I’ve noticed traders who survive futures trading usually have a calm, rule-based approach.

FAQs: Futures Trading Explained

1. Is futures trading risky?

Yes. High leverage makes risk significant.

2. Can beginners trade futures?

Only after understanding basics and risk management.

3. Is futures trading better than options?

Neither is better. They serve different purposes.

4. Do futures have expiry dates?

Yes. All futures contracts expire.

5. Can losses exceed margin in futures trading?

Yes. This is a major risk.

6. Is futures trading suitable for long-term investing?

No. It’s mainly used for short- to medium-term trading.

7. What is mark-to-market in futures?

Daily settlement of profit and loss.

8. How long does it take to understand futures trading?

Several months of consistent learning and practice.

Final Thoughts

If you were searching for futures trading explained without hype, here’s the reality:

-

It’s powerful

-

It’s risky

-

It demands discipline

Futures trading is not forgiving.

But when respected, it becomes a precise trading instrument.