How Beginners Should Start Stock Market With Small Money and Big Patience

Let me say this upfront — the stock market is not hard, but the way it’s explained usually is. Most beginners don’t fail because they lack money or intelligence. They fail because nobody tells them how beginners should start stockmarket the right way — step by step, without hype, without fake promises.

If you’re starting from zero, feeling confused, scared, or overwhelmed, you’re exactly where you should be. This guide is written like I’m sitting next to you, explaining things the way I wish someone had explained them to me.

No shortcuts. No guru nonsense. Just the real path.

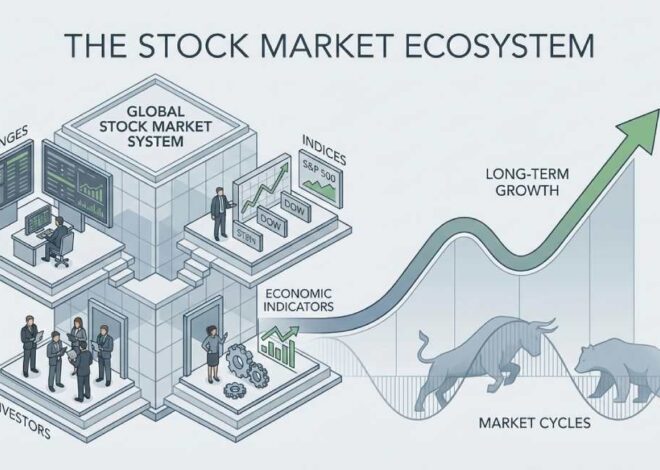

How to Start with Stock Market for Beginners?

Before charts, before profits, before apps — beginners must understand what they are getting into.

The stock market is simply a place where you:

-

Buy ownership in companies

-

Hold it patiently

-

Let time and business growth work for you

That’s it. Everything else is noise.

From my experience, beginners rush into “what stock to buy” before learning “how the system works.” That’s backward.

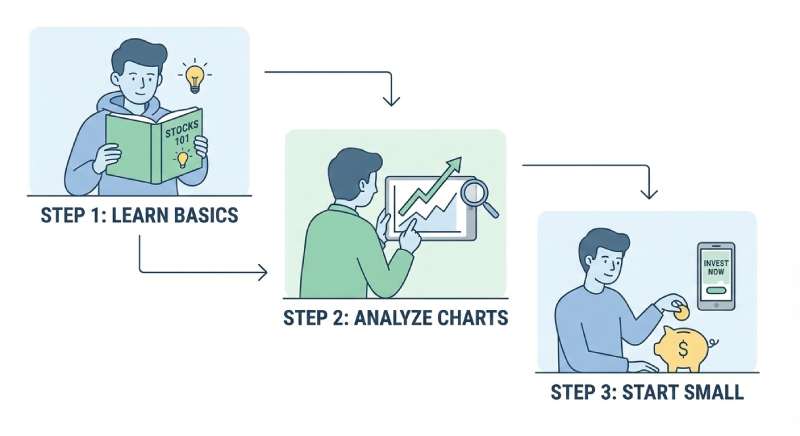

Step 1: Learn the basics first

You should clearly understand:

-

What stocks are

-

How prices move

-

Why markets go up and down

Step 2: Start small and slow

You don’t need big money. You need consistency and patience.

Step 3: Think like an investor, not a gambler

Beginners who treat the market like a casino usually leave broke.

If you’re wondering how beginners should start stockmarket, the answer is simple:

👉 Start slow, stay curious, avoid shortcuts.

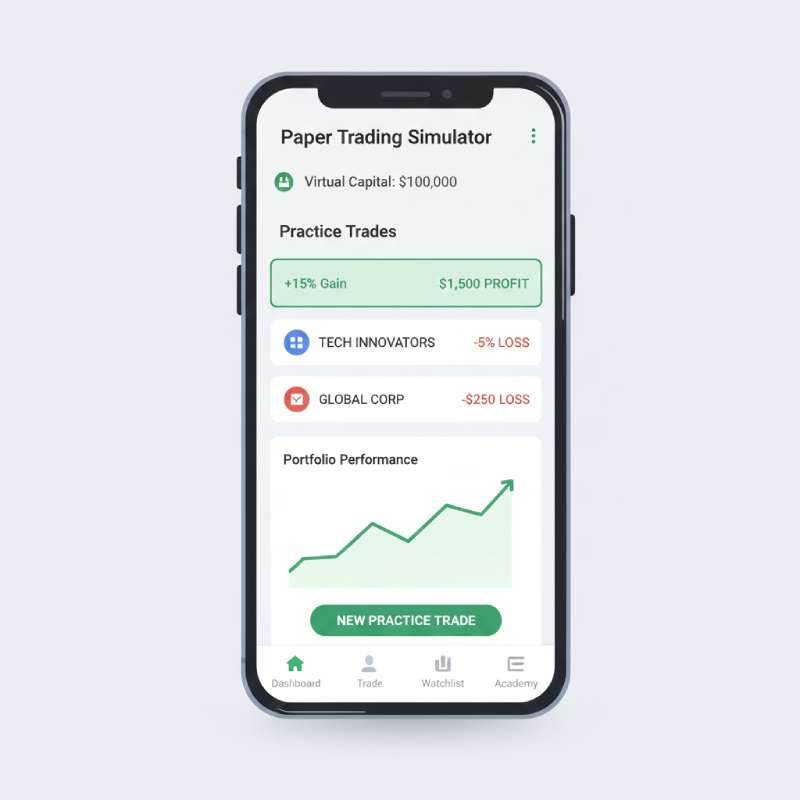

Best Stock Market Simulators for Beginners

One of the smartest things beginners can do is practice without risking real money.

This is where simulators help.

What are stock market simulators?

They are apps or platforms where you trade with virtual money, but real market prices.

I find it interesting how many people skip this step and jump straight into live trading. That’s like learning to drive on a highway without practice.

Why simulators matter for beginners

-

No real loss

-

Builds confidence

-

Helps understand order types

-

Teaches emotional control

Simulators are perfect when learning how beginners should start stockmarket safely.

Use them to:

-

Test strategies

-

Understand mistakes

-

Build discipline

Practice first. Earn later.

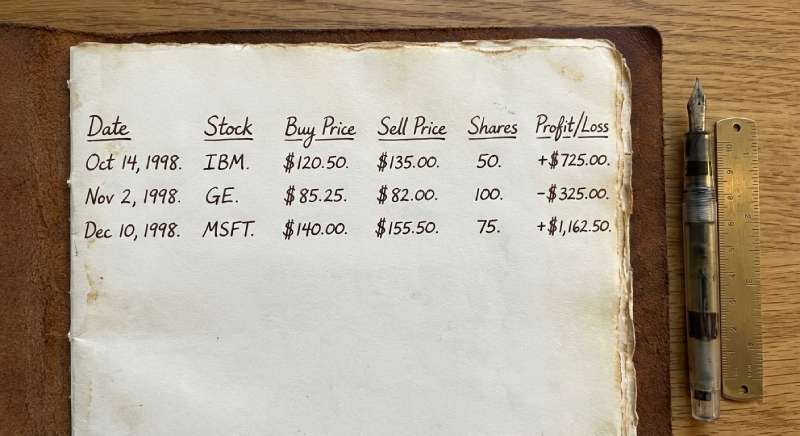

What Is Paper Trading?

Paper trading is the old-school version of simulation — and it still works.

Simple meaning

Paper trading means:

-

Writing down trades

-

Tracking prices

-

Calculating profit or loss manually

No app. No execution. Just logic.

From my experience, paper trading teaches patience and clarity better than many apps.

Why paper trading is powerful for beginners

-

Zero pressure

-

Forces thinking before action

-

Builds habit of planning

If you want to truly understand how beginners should start stockmarket, paper trading is one of the cleanest starting points.

What Is the 3-5-7 Rule in Stocks?

This rule is about risk management, not profits.

Meaning of the 3-5-7 rule

-

3% loss per stock

-

5% loss per sector

-

7% loss overall portfolio

Once you cross these limits, you stop. Period.

I’ve seen beginners blow accounts because they had no exit rule. This rule keeps emotions in check.

When learning how beginners should start stockmarket, protecting capital matters more than making money.

How to Earn Rs 1000 Per Day in the Share Market?

Let’s be honest here.

This question is popular — and dangerous.

Reality check

Earning ₹1000 per day:

-

Is not beginner-friendly

-

Requires capital, skill, discipline

-

Comes with real risk

Most beginners chase daily income and lose long-term wealth.

From my observation, beginners should focus on learning consistency, not daily targets.

If you’re serious about how beginners should start stockmarket, think in months and years, not days.

What Is the 7-5-3-1 Rule in SIP?

This rule helps beginners understand long-term investing power.

The idea

-

7 years → stability

-

5 years → visible growth

-

3 years → compounding starts

-

1 year → learning phase

SIP works best when time is your partner.

I’ve noticed beginners quit SIPs too early. They expect miracles in months. That’s not how markets reward patience.

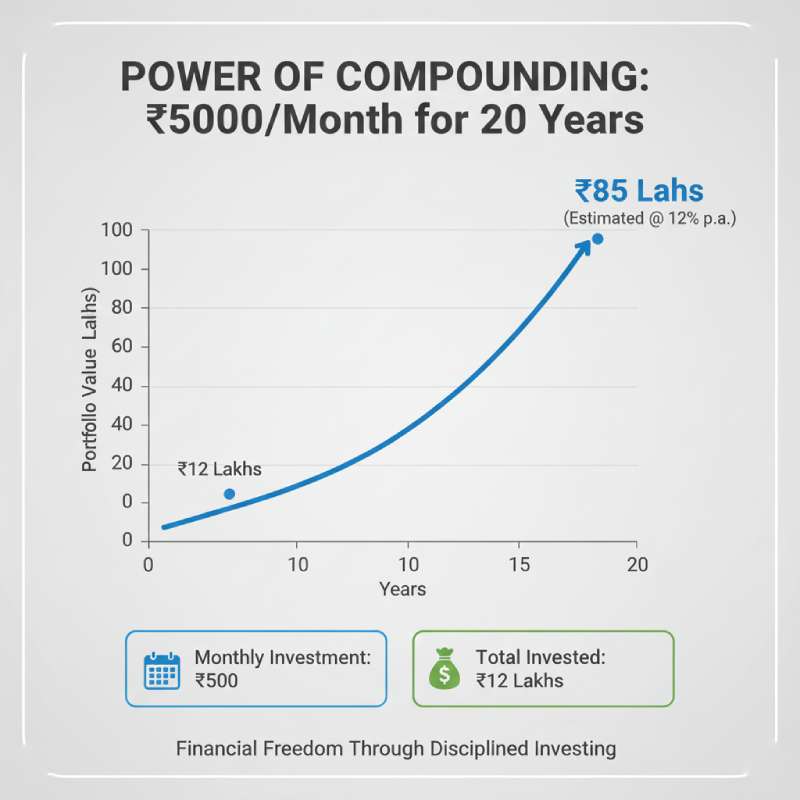

How Much Will 5000 Grow in 20 Years?

This is where investing becomes exciting — and realistic.

Assume:

-

Monthly investment: ₹5000

-

Time: 20 years

-

Average return: 12%

Result?

👉 ₹50–60 lakhs (approx)

That’s not magic. That’s math + time.

When beginners ask how beginners should start stockmarket, this is the mindset they need — small amounts, long duration.

Free Stock Market Courses for Beginners

You don’t need paid courses on day one.

What beginners should focus on

-

Basics of stock market

-

Fundamental analysis

-

Risk management

-

Psychology

I personally believe free learning is enough for beginners — if they actually apply it.

Courses don’t make money. Discipline does.

What Is the No. 1 Rule of Trading?

There are many rules. But one stands above all.

👉 Never lose money you can’t afford to lose.

That’s it.

Everything else comes later.

Most beginners ignore this rule — and pay the price.

If someone asks me how beginners should start stockmarket, I always say:

Protect capital first. Profits will follow.

Best Stock Market Books for Beginners

Books teach patience — something YouTube can’t.

Why books matter

-

Structured learning

-

No hype

-

Deep understanding

From my experience, beginners who read books last longer in the market.

Reading builds thinking. Thinking builds confidence.

Common Mistakes Beginners Make (Read This Twice)

Let’s call it out clearly.

Beginners usually:

-

Follow tips blindly

-

Overtrade

-

Ignore risk

-

Chase quick money

-

Quit too early

I’ve seen this pattern repeat endlessly.

If you truly want to understand how beginners should start stockmarket, avoid these mistakes more than chasing profits.

Personal Observations (Hard Truth)

I find it interesting that:

-

Beginners want advanced strategies

-

But skip basic discipline

From my experience:

-

Slow learners survive longer

-

Calm investors outperform smart traders

-

Consistency beats intelligence

The market doesn’t reward excitement. It rewards patience and process.

FAQs: How Beginners Should Start Stockmarket

1. Is stock market risky for beginners?

Yes, if you rush. No, if you learn slowly and manage risk.

2. How much money should beginners start with?

Start with an amount you’re okay losing while learning.

3. Should beginners do trading or investing?

Investing first. Trading later.

4. Can beginners earn monthly income from stocks?

Not immediately. Focus on learning and long-term growth.

5. Is SIP better than stocks for beginners?

SIP is safer and simpler for beginners.

6. How long does it take to understand stock market?

6–12 months with consistent learning and practice.

7. Do beginners need mentors?

Helpful, but not mandatory. Avoid fake gurus.

8. Can beginners fail in stock market?

Yes — but failure is part of learning if losses are controlled.

Final Thoughts

If you’re serious about how beginners should start stockmarket, remember this:

-

Learn before earning

-

Protect capital

-

Respect time

-

Stay disciplined

The stock market doesn’t care about shortcuts.

But it rewards those who stay long enough to understand it.