Is QQQ ETF a Good Investment? A Realistic Look at Growth, Risk, and Long-Term Potential

People usually don’t ask “Is QQQ ETF a good investment?” casually.

They ask it after seeing QQQ outperform the broader market and wondering:

“Am I missing out by not investing in this?”

This article is not here to hype QQQ.

It’s here to explain what QQQ really is, who it’s for, and who should stay away.

What Is the QQQ ETF?

QQQ is an exchange-traded fund (ETF) that tracks the NASDAQ-100 index.

In simple terms:

-

It invests in 100 of the largest non-financial companies listed on Nasdaq

-

Heavy focus on technology and innovation-driven companies

-

Growth-oriented by nature

I find it interesting how many people think QQQ is “just a tech ETF.”

It’s more accurate to call it a growth-focused ETF with a tech tilt.

How QQQ ETF Works

When you invest in QQQ:

-

Your money is concentrated in growth-heavy companies

-

Tech giants dominate the portfolio

-

Performance is closely tied to innovation cycles

Unlike broad-market ETFs, QQQ doesn’t try to balance everything.

It leans hard into growth — and that has consequences.

From my experience, investors either love QQQ for this reason or fear it for the same reason.

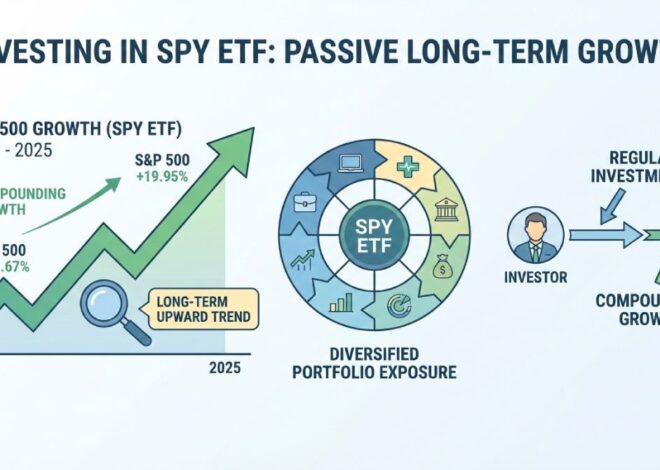

Is QQQ ETF a Good Investment for Long-Term Growth?

For growth-focused investors, QQQ can be very attractive.

Historically, QQQ has:

-

Outperformed broader indexes during tech booms

-

Delivered strong long-term growth

-

Experienced sharper drawdowns during market stress

Here’s the key point:

👉 QQQ rewards patience only if you can tolerate volatility.

If your time horizon is long and your stomach is strong, QQQ can play a role.

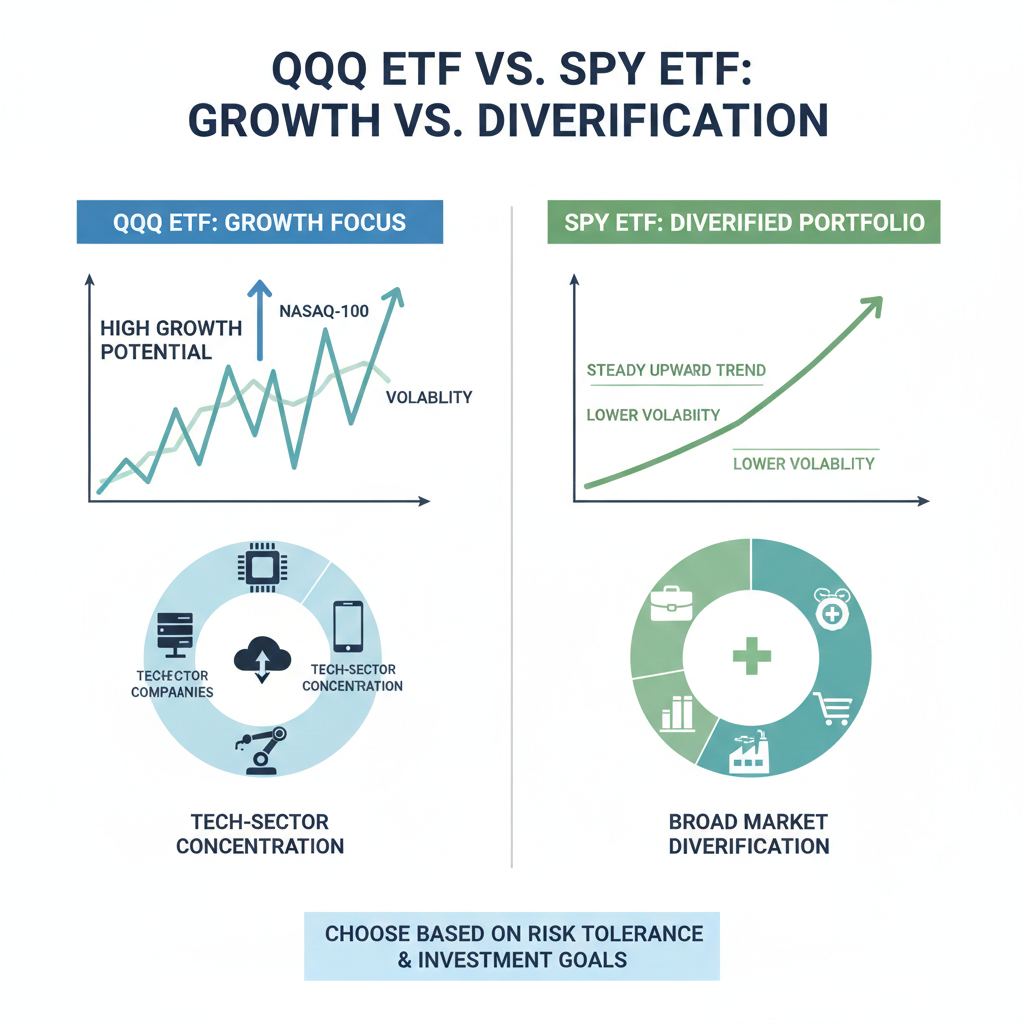

QQQ ETF vs SPY ETF

Compared to the SPY ETF, QQQ focuses more heavily on growth-oriented companies and tends to experience higher volatility over market cycles.

QQQ ETF

-

Growth-focused

-

Heavy tech exposure

-

Higher volatility

SPY ETF

-

Broad market exposure

-

More diversified

-

Relatively lower volatility

I’ve noticed many investors use SPY as a foundation and QQQ as a growth booster — not a replacement.

Risks of Investing in QQQ ETF

Let’s talk about the uncomfortable part.

Risks include:

-

Sector concentration (especially tech)

-

Higher drawdowns during crashes

-

Underperformance during value-driven markets

QQQ does not protect you during tech downturns.

It amplifies both optimism and fear.

Understanding Is QQQ ETF a good investment means accepting that returns won’t be smooth.

Is QQQ ETF a Good Investment for Beginners?

Honest answer: It depends.

QQQ may suit beginners who:

-

Understand volatility

-

Invest for the long term

-

Avoid panic selling

QQQ may NOT suit beginners who:

-

Expect stability

-

Check portfolios daily

-

Fear temporary losses

From my experience, beginners who start with QQQ without understanding risk often exit at the worst time.

Dividend and Income Aspect of QQQ

QQQ is not an income ETF.

-

Dividends are low

-

Growth is the main objective

-

Income investors may feel disappointed

If income is your priority, QQQ is likely not the best choice.

How Much QQQ Should You Own?

There’s no universal rule.

But QQQ works best when:

-

Used as a portion of a portfolio

-

Combined with diversified ETFs

-

Not treated as the only investment

I’ve seen portfolios become unstable when QQQ dominates too much.

Common Mistakes Investors Make with QQQ ETF

These mistakes show up often:

-

Chasing QQQ after big rallies

-

Panic selling during tech corrections

-

Treating QQQ as a “safe” ETF

I find it interesting how performance attracts investors — but discipline keeps them invested.

Personal Observations (Real Talk)

From my experience:

-

QQQ performs best when innovation thrives

-

Volatility is the price of higher growth

-

Long-term conviction matters more than timing

I’ve noticed investors who understand QQQ’s role sleep better than those who blindly chase returns.

FAQs: Is QQQ ETF a Good Investment?

-

Is QQQ ETF risky?

Yes. It’s more volatile than broad-market ETFs. -

Is QQQ good for long-term investing?

Yes, if you can tolerate ups and downs. -

Can beginners invest in QQQ?

Yes, but only with proper expectations. -

Does QQQ pay dividends?

Yes, but dividends are low. -

Is QQQ better than SPY?

Not better — just different goals. -

Can QQQ crash?

Yes, especially during tech downturns. -

Is QQQ suitable for retirement portfolios?

Only as a growth portion, not the core. -

How long should QQQ be held?

Ideally 10+ years for growth-focused investors.

Final Thoughts

So, is QQQ ETF a good investment?

If your goal is:

-

Long-term growth

-

Exposure to innovation

-

Acceptance of volatility

Then QQQ can make sense as part of a portfolio.

It’s not calm.

It’s not defensive.

But it reflects where growth has historically come from.