Is SPY ETF a Good Investment? A Clear, No-Hype Breakdown for Long-Term Investors

A lot of investors already invest in something like SPY…

They just don’t realize SPY exists.

When people ask “Is SPY ETF a good investment?”, what they’re really asking is:

“Can I grow my money steadily without constantly picking stocks?”

This article answers that honestly.

What Is the SPY ETF? (Simple Explanation)

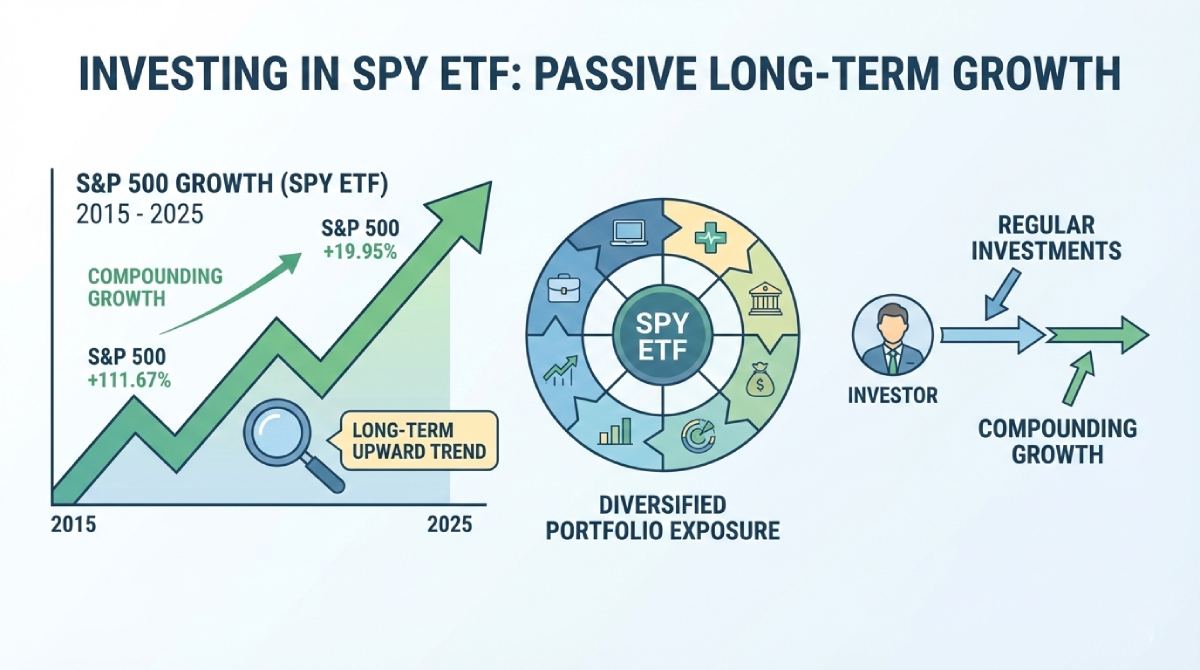

SPY is an exchange-traded fund (ETF) that tracks the S&P 500 index.

That means:

-

You’re not buying one company

-

You’re buying exposure to 500 large U.S. companies

-

Your returns follow the overall U.S. market

I find it interesting how people try to beat the market before understanding what the market itself offers.

If I had to explain SPY in one line:

SPY lets you invest in the U.S. stock market’s biggest companies through a single fund.

How SPY ETF Works

When you invest in SPY:

-

Your money is spread across 500 companies

-

Winners and losers balance out

-

Long-term growth depends on economic expansion

There’s no stock selection stress.

No rebalancing effort from you.

From my experience, this simplicity is exactly why SPY attracts long-term investors.

Is SPY ETF a Good Investment for Beginners?

Short answer: Yes — for most beginners.

Why?

-

Instant diversification

-

No need to analyze individual stocks

-

Easy to understand

-

Historically consistent over long periods

Beginners often lose money not because markets fail, but because decisions are emotional. SPY reduces decision-making errors.

Historical Performance of SPY ETF (Reality Check)

Over long periods, SPY has:

-

Reflected overall U.S. economic growth

-

Delivered solid long-term returns

-

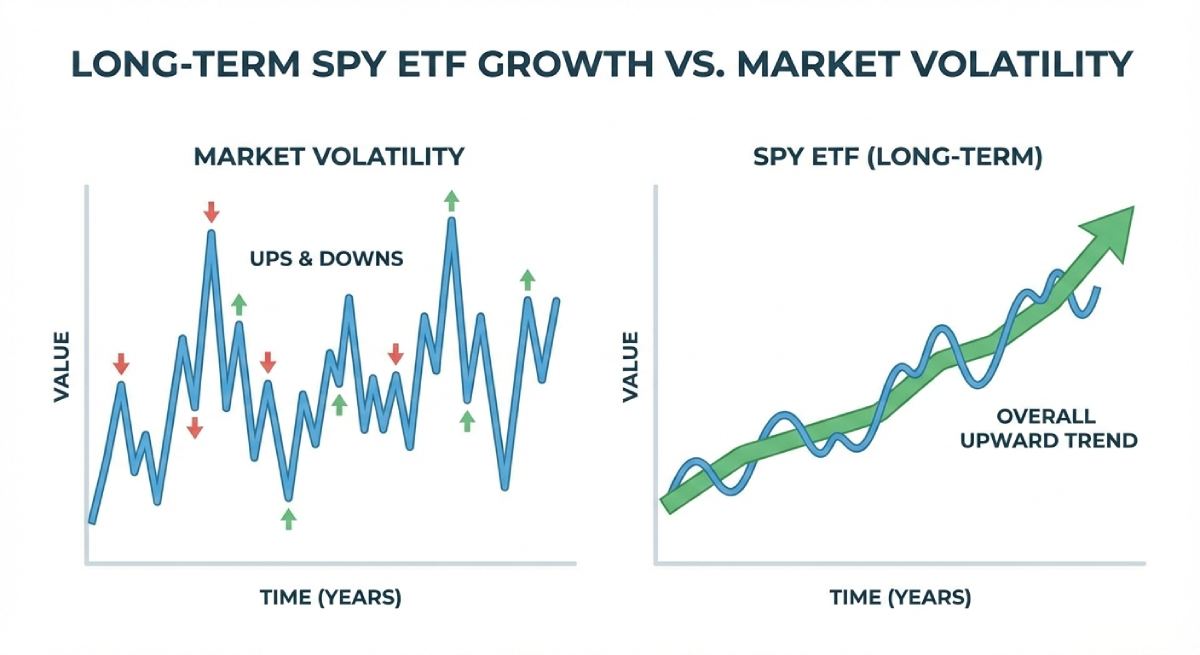

Experienced short-term volatility

Important reminder:

👉 SPY goes down during market crashes

👉 But it has historically recovered given time

From my observation, people panic during downturns instead of zooming out.

Is SPY ETF a Good Investment for the Long Term?

This is where SPY truly shines.

SPY is best suited for:

-

Long-term investing

-

Retirement planning

-

Passive wealth building

It is not meant for:

-

Quick profits

-

Daily trading excitement

If your time horizon is 10–20 years, SPY becomes far more attractive.

Risks of Investing in SPY ETF

Let’s not pretend it’s perfect.

Risks include:

-

Market crashes

-

Economic slowdowns

-

Short-term volatility

SPY does not protect you from market downturns.

It simply ensures you move with the market, not against it.

Understanding Is SPY ETF a good investment means accepting temporary declines.

SPY ETF vs Picking Individual Stocks

This comparison matters.

SPY ETF

-

Broad diversification

-

Lower effort

-

Lower emotional stress

Individual stocks

-

Higher potential upside

-

Higher risk

-

Requires skill and discipline

I’ve seen many investors underperform SPY because they overtrade or chase trends.

Who Should Invest in SPY ETF?

SPY is ideal for:

-

Beginners

-

Long-term investors

-

Passive investors

-

People who don’t want daily monitoring

It may not suit:

-

Short-term traders

-

People seeking quick gains

From my experience, SPY rewards patience far more than intelligence.

How Much Should You Invest in SPY?

There’s no fixed rule.

But SPY works best when:

-

You invest consistently

-

You stay invested during downturns

-

You avoid timing the market

Small, regular investments over time often beat large, emotional bets.

Common Mistakes Investors Make with SPY ETF

These mistakes repeat often:

-

Selling during market crashes

-

Expecting steady monthly gains

-

Treating SPY like a trading stock

I find it interesting how people abandon long-term tools during short-term fear.

Personal Observations (Real Talk)

From my experience:

-

SPY builds wealth quietly

-

It doesn’t feel exciting day-to-day

-

But it compounds relentlessly over time

I’ve noticed investors who stick with SPY usually sleep better than active traders.

FAQs: Is SPY ETF a Good Investment?

-

Is SPY ETF safe?

No investment is risk-free, but SPY is diversified. -

Can beginners invest in SPY?

Yes, it’s beginner-friendly. -

Is SPY good for retirement?

Yes, especially for long-term goals. -

Does SPY pay dividends?

Yes, dividends are distributed periodically. -

Can SPY crash?

Yes, during market downturns. -

Is SPY better than mutual funds?

Often yes, due to lower costs and flexibility. -

Is SPY good for short-term investing?

No, it’s better for long-term holding. -

How long should I hold SPY?

Ideally 10+ years for best results.

Final Thoughts

So, is SPY ETF a good investment?

If your goal is:

-

Long-term growth

-

Simplicity

-

Reduced stress

Then yes — SPY is one of the most practical investment options available.

It won’t make you rich overnight.

But it helps you build wealth the way it actually happens — slowly, steadily, and consistently.