Mutual Funds Explained: A Simple, No-Nonsense Guide for Long-Term Investors

Everyone talks about investing. Few actually understand it.

And somehow, mutual funds always show up in the conversation — recommended by banks, YouTube “gurus”, and even that one relative who checks NAV every morning. But most people still invest without knowing what’s really happening behind the scenes.

So let’s slow down and break this properly. Not in textbook language. Not in sales language. Just clean, practical understanding — the kind that actually helps you make better decisions.

What Are Mutual Funds

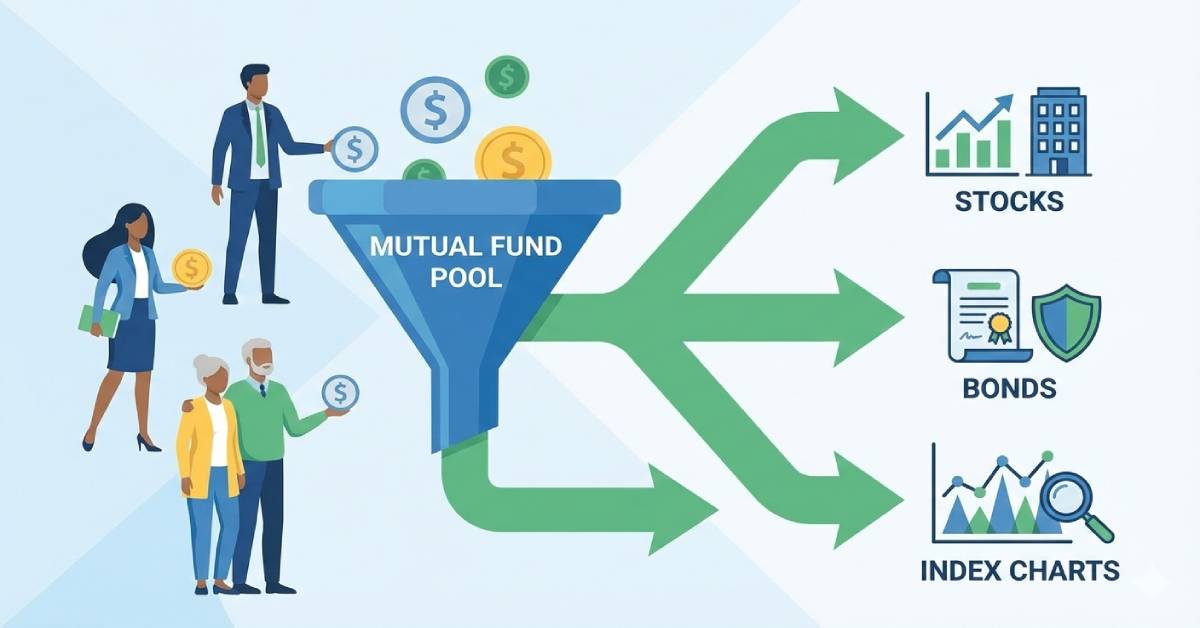

At the simplest level, mutual funds are pooled investments.

Multiple investors put their money together. That combined money is then invested in stocks, bonds, or other assets by a professional fund manager.

You don’t pick individual stocks.

>You buy units of a fund and let the system do the work.

I find it interesting how this idea hasn’t really changed for decades. The packaging changed. The core logic didn’t. Pool money. Diversify risk. Let professionals handle execution.

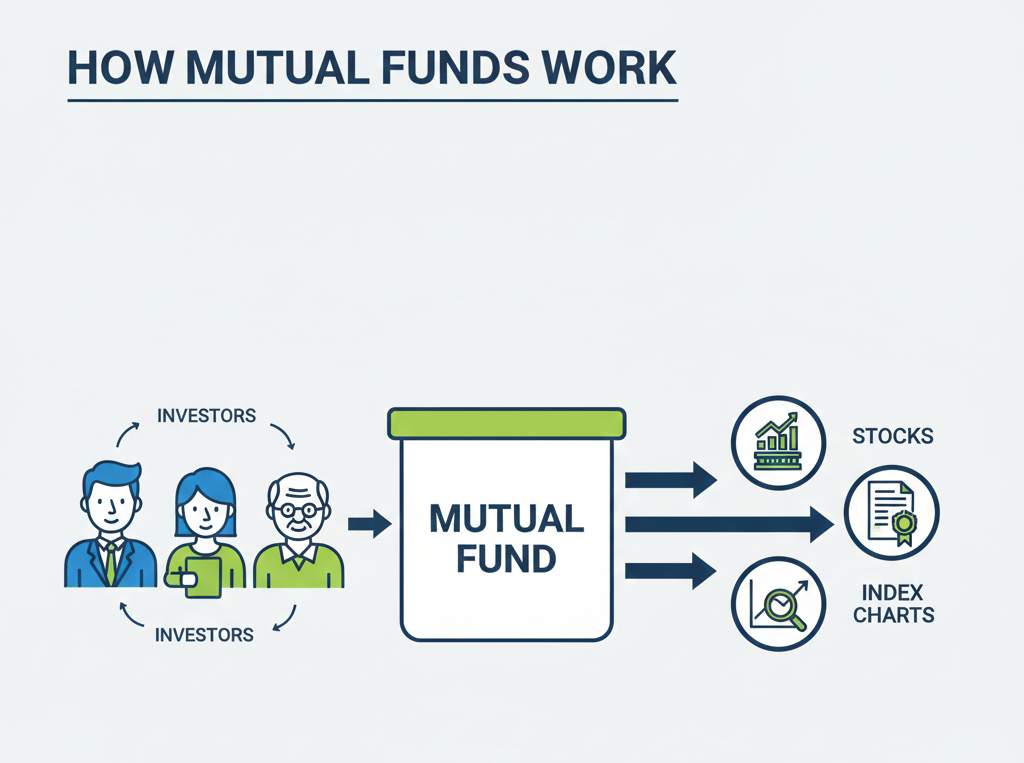

How Mutual Funds Work

This is where most confusion starts — so let’s clear it step by step.

When you invest in mutual funds, you are buying units of a fund. The price of each unit is called NAV. The fund uses your money to invest based on its objective.

Your returns depend on how the underlying investments perform. Simple.

NAV Explained

NAV stands for Net Asset Value.

Think of it as the per-unit price of the fund. It’s calculated daily based on the total value of assets minus expenses, divided by total units.

Important reality check:

-

NAV going up doesn’t mean the fund is “expensive”

-

NAV going down doesn’t mean the fund is “cheap”

From my experience, beginners obsess over NAV instead of portfolio quality — and that’s backwards thinking.

Expense Ratio

Running a fund isn’t free.

That’s where the expense ratio comes in.

It covers:

-

Fund management

-

Administration

-

Marketing

-

Operations

Lower is generally better. But ultra-low isn’t always best if performance suffers.

Old-school wisdom still holds here: you get what you pay for — but don’t overpay.

Role of the Fund Manager

The fund manager is the brain behind the fund.

They decide:

-

What to buy

-

What to sell

-

When to rebalance

-

How much risk to take

A good manager doesn’t chase trends. They follow process and discipline.

I’ve seen average markets still reward good managers — and strong markets expose bad ones.

Types of Mutual Funds

This is where your cluster articles will branch out beautifully.

Equity Funds

Equity funds invest mainly in stocks.

Higher risk. Higher potential returns. Best suited for long-term goals.

These work well when:

-

You have time

-

You can handle volatility

-

You don’t panic on market dips

Equity-based mutual funds reward patience. Always have.

Debt Funds

Debt funds invest in bonds and fixed-income instruments.

Lower risk compared to equity. More stable returns.

Good for:

-

Capital protection

-

Short to medium goals

-

Conservative investors

They don’t make headlines. But they quietly do their job.

Index Funds

Index funds simply track a market index.

No stock picking. No manager bias. Low cost.

This is where traditional investing meets modern efficiency.

I personally like how index-based mutual funds remove emotion from investing entirely.

Mutual Funds vs Other Investments

Let’s compare without bias.

-

Fixed Deposits → Safe, predictable, but often lose to inflation

-

Direct Stocks → High control, high risk, time-consuming

-

Real Estate → Capital heavy, illiquid

-

Mutual Funds → Balanced approach, diversified, scalable

Mutual funds sit in the sweet spot. Not flashy. Not boring. Just effective.

How to Invest in Mutual Funds

This part matters more than people admit.

Step 1: Define Your Goal

Short term? Long term? Wealth creation? Income?

No goal = bad investment, no matter how good the fund is.

Step 2: Choose the Right Fund Category

Don’t mix equity funds with short-term goals. That’s asking for stress.

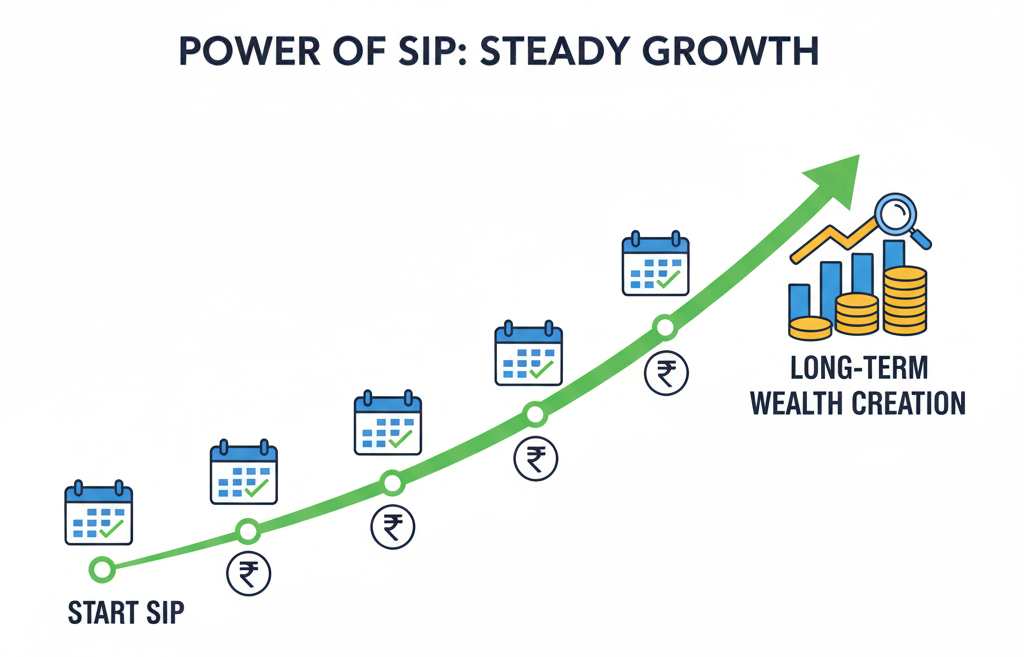

Step 3: Decide SIP or Lump Sum

SIPs help:

-

Reduce timing risk

-

Build discipline

-

Stay invested

Lump sum works when valuation and timing align.

From my experience, SIPs win for most people simply because they remove decision fatigue.

Step 4: Stay Invested

Switching funds frequently kills returns.

Time in the market > timing the market.

That’s old advice because it still works.

Risks, Returns & Taxation

Let’s talk real risks — not marketing risks.

Risks

-

Market volatility

-

Poor fund management

-

Behavioural mistakes (panic selling)

Most losses come from the last one.

Returns

Returns depend on:

-

Asset class

-

Time horizon

-

Discipline

Mutual funds don’t guarantee returns. But historically, disciplined investing has rewarded consistency.

Taxation

Tax depends on:

-

Fund type

-

Holding period

This is where planning matters. Ignoring tax is like leaking money quietly.

Who Should Invest in Mutual Funds

Short answer: almost everyone.

Long answer:

-

Salaried professionals

-

Business owners

-

Beginners

-

Long-term planners

-

Passive investors

If you want growth without living inside market charts, mutual funds make sense.

Common Mistakes People Make

I see these all the time:

-

Chasing last year’s top fund

-

Investing without goals

-

Panicking during corrections

-

Ignoring expense ratios

-

Over-diversifying

Good investing is boring. And boring is powerful.

Why Mutual Funds Still Matter Today

Markets evolve. Products change. But the core advantage remains:

-

Diversification

-

Professional management

-

Accessibility

-

Scalability

That’s why mutual funds survived every market cycle so far.

FAQs About Mutual Funds

1. Are mutual funds safe for beginners?

Yes, if you choose the right category and stay disciplined.

2. Can I lose money in mutual funds?

Yes. Especially in the short term or if you panic.

3. How long should I stay invested?

Ideally 5+ years for equity-oriented mutual funds.

4. Is SIP better than lump sum?

For most people, yes. It builds habit and reduces timing risk.

5. How many mutual funds should I own?

Enough to diversify, not enough to confuse you. Usually 3–6 is plenty.

6. Do mutual funds beat inflation?

Over long periods, equity-oriented funds usually do.

7. Can I withdraw anytime?

Most open-ended funds allow redemption anytime, subject to exit load.

Final Thought

Mutual funds are not magic.

They’re not shortcuts.

They’re structured, time-tested tools.

Use them with patience, clarity, and discipline — and they quietly do the heavy lifting.