43 Stock Market Terms Every Investor Should Know

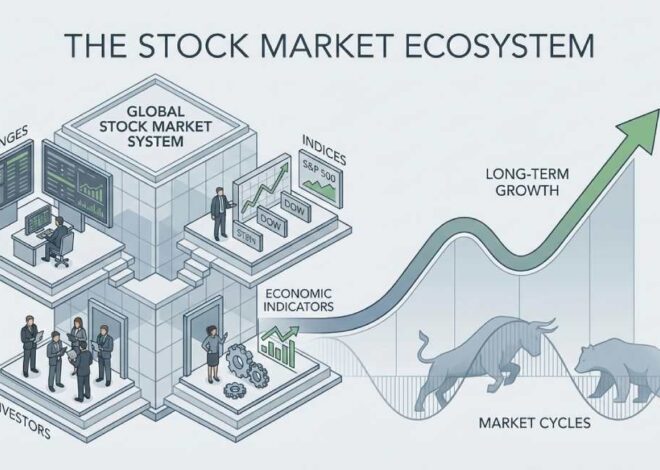

Before investing real money, it’s important to understand stock market terms every investor should know, because without knowing the language of the market, even good investment decisions can turn into costly mistakes. Most people don’t lose money in the stock market because they choose bad stocks — they lose money because of the lack of understanding of the words used.

If terms like market cap, dividend yield, bear market, or P/E ratio seem like alien language to you, then you are among many who feel the same. These are stock market vocabularies that every investor should be familiar with because, without comprehension, investment becomes a matter of luck.

This tutorial explains the most crucial stock market terms in easy words so that you could steer clear of confusion and invest with understanding.

Why Knowing Stock Market Terms Matters for Investors

The stock market has its own jargon. If you can’t speak it, you will always lag behind.

Knowing basic stock market terms can assist you in:

- Accurately understanding financial reports

- Grasping company’s business results

- Resisting emotional decisions

- Having trustful, fearless investment

That is the reason why becoming familiar with stock market terms every investor should know is the primary step before committing significant money.

Basic Stock Market Terms Every Investor Should Know

Stock (Share)

A stock stands for a share in a company. When individuals purchase shares, they representatives of a small portion of that firm are.

Stock Market

The area where the buying and selling of the shares of publicly listed companies take place is called Stock market .

Stock Exchange

A stock exchange is a controlled market where trading of stocks occurs, like the exchanges in India or the US.

Listed Company

A listed company is an organization whose shares can be purchased and sold by the public on a stock exchange.

Index

An index measures the change in value of a select group of stocks. It serves as a gauge of the overall market or a particular sector.

Investment & Portfolio Terms Investors Must Know

Portfolio

A portfolio is a group of investments that an individual owns — stocks, mutual funds, ETFs, or any other assets type.

Diversification

Diversification is an approach in which you don’t have all your investments in one company or industry in order to lower the risk.

Asset Allocation

Asset allocation refers to the division of one’s investment between stocks, bonds, cash, and other assets.

Long-Term Investing

Long-term investing means purchasing great assets and keeping them for a long time, allowing compounding to play its role.

Compounding

Compounding refers to the process in which the earnings you receive start to work for you, too. It begins very gradually, but eventually, it gets very effective.

Stock Pricing & Valuation Terms Explained

Market Capitalization

Market capitalization refers to the size of a business. It can be assessed by the stock price multiplied by the total number of shares outstanding.

Share Price

Share price is the amount at which one unit of a company’s stock is currently valued by the market.

P/E Ratio (Price-to-Earnings)

The P/E ratio measures the relationship between a company’s stock price and its earnings. It allows investors to estimate the suitability of a stock price the level of the stock price relative to the company’s earnings or in other words, whether it is expensive or reasonably priced is made by the investors with the help of this ratio.

Book Value

Book value indicates the company’s equity by reflecting its net worth on the balance sheet.

Intrinsic Value

Intrinsic value is a term used in conjunction with stock price and signifies the true worth of a stock derived from its fundamental aspects rather than from its market value.

Market Movement & Trend Terms Every Investor Should Know

Bull Market

Bull market is a term used when stock prices generally go up and investors are highly confident.

Bear Market

Bear market is when prices decline over an extended period usually due to economic downturn or investors’ panic.

Market Correction

A market correction is a temporary drop of about 10%, which is quite a common and healthy occurrence.

Volatility

Volatility is related to the extent of a stock price’s movement in a short duration.

Market Sentiment

Market sentiment essentially represents the feeling or attitude of investors, whether it is geared towards optimism or fear.

Risk & Return Terms Investors Should Understand

Risk

It represents the chance of losing money on an investment or not getting the expected returns.

Return

It is the gain or loss made on an investment.

Risk-Reward Ratio

The term risk-reward ratio is used to describe a comparison of potential profits versus potential losses.

Capital Gain

This Capital gain refers to the money gained when a stock is sold at a price higher than the purchase price.

Capital Loss

Capital loss is the money lost when selling a stock for less than it was bought.

These concepts form the backbone of stock market terms every investor should know, especially for those focused on long-term wealth creation rather than short-term trading.

Income & Dividend-Related Stock Market Terms

Dividend

The part of the company’s profits that is distributed among shareholders is called Dividend .

Dividend Yield

This Dividend yield tells you the amount you will get as dividend income concerning the stock price.

Dividend Payout Ratio

Dividend payout ratio displays a proportion of profits a company pays out to shareholders as dividends.

Passive Income

Passive income refers to income streams which do not involve active work — dividends can be a typical example.

Trading & Order Terms (Investor-Level Only)

Buy Order

A buy order means that you are willing to buy shares at a certain price or the current market price.

Sell Order

A sell order means that one is willing to sell shares at a price that they have set or agreed on.

Market Order

Market order is the one which gets executed right away at the best current market price.

Limit Order

Limit order is only executed at the desired price or any price better than that.

Liquidity

Liquidity is the term used to describe the ease at which a stock can be converted into cash without price changes.

Company & Corporate Action Terms Investors Should Know

Earnings

Earnings are basically the net income of a company after deducting the expenses.

Revenue

In business terms, revenue means the total amount of money that comes from sales or services.

Bonus Shares

Bonus shares represent free shares given to the current shareholders at no cost.

Stock Split

Stock split is a situation where a company divides its existing shares and lowers their price without affecting total value.

Buyback

An event when a company purchases its shares from the free market is known as a buyback.

Psychology & Behavior Terms in Investing

Fear & Greed

Fear provokes people to sell quickly; on the contrary, greed makes people buy excessively. If left unchecked, both return with a loss.

FOMO (Fear of Missing Out)

FOMO is a phenomenon that drives investors to invest simply because they see prices going up.

Patience

Patience is a seldom appreciated investing talent but also one of the most rewarding ones.

Discipline

Discipline means following your investment plan despite all emotional distractions attempting to take over your will.

Final Thoughts: Learn the Language Before You Invest

Knowing stock market terms that are essential for every investor is not something that can be ignored — it is a basic requirement.

You don’t have to comprehend everything right from the start. However, if you:

- have a basic understanding of stock market terms

- are able to interpret price, value, and risk

- remain composed during market fluctuations

Then, you have a head start over most investors.

Firstly learn the language, then allow time and discipline to take care of the rest.