Trading: How This Game Really Works (No Filters, No Hype)

Trading is not a shortcut to wealth.

It’s not passive income.

And it’s definitely not easy money.

I find it interesting how people respect doctors and engineers for years of training, but expect trading profits in three months. That mindset alone explains why most people lose.

Trading is an old craft. Markets have existed for centuries. The tools changed. Human behavior didn’t.

This article is built as a pillar page. Every section connects logically. No filler. No motivational fluff. Just how trading actually works and who it’s really for.

What Is Trading (Simple, Honest Definition)

Trading means buying and selling financial instruments to profit from price movement.

That’s it.

You’re not investing in a company’s vision.

You’re exploiting short- to medium-term price inefficiencies.

You can:

-

Buy first, sell later (long)

-

Sell first, buy later (short)

At its core, trading is a decision-making business under uncertainty.

Types of Trading (Choose Based on Personality, Not Trends)

Different trading styles exist because people think, react, and live differently. Copying someone else’s style usually ends badly. How trading works can vary significantly across different types of trading, depending on the timeframe, risk, and capital involved.

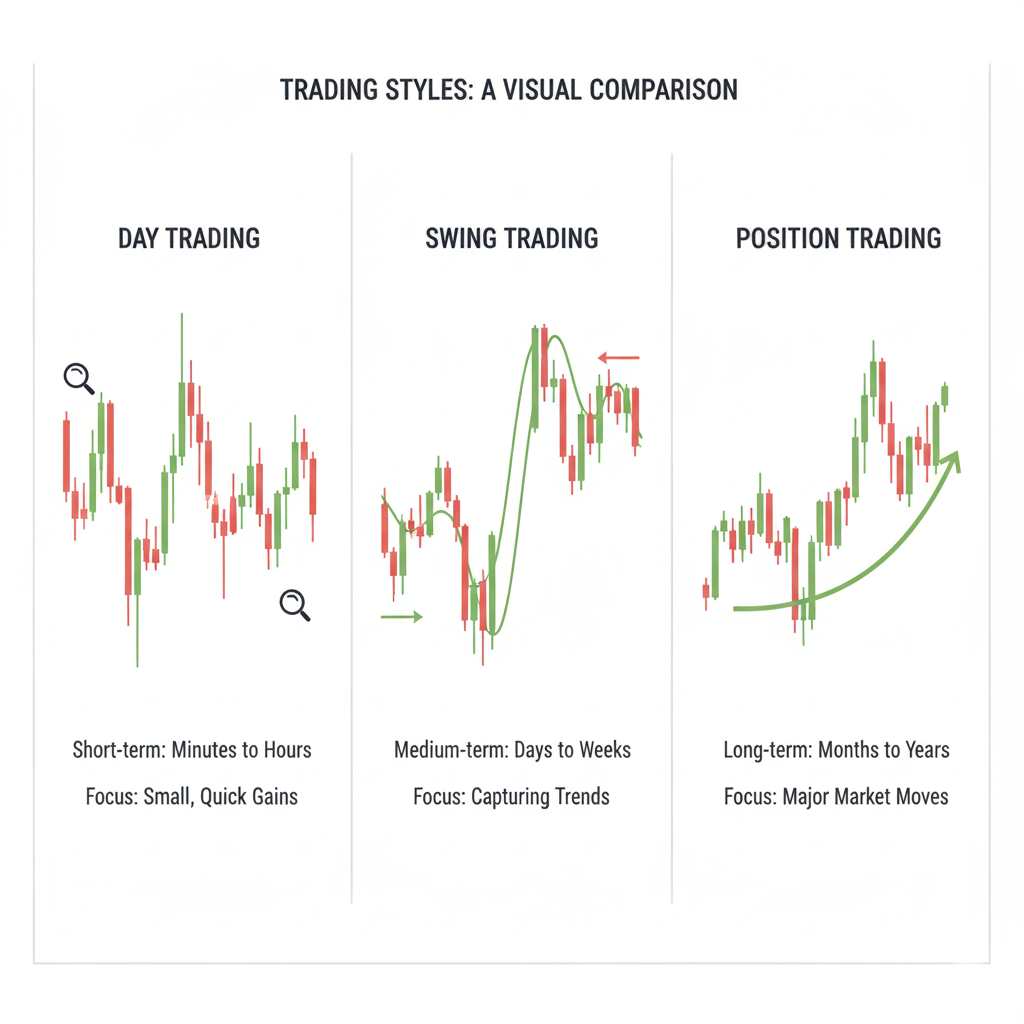

1. Day Trading

Day trading means opening and closing trades within the same day.

Characteristics

-

Fast decision-making

-

High screen time

-

Emotional intensity

-

No overnight risk

Reality Check

From my experience, beginners jump here because it looks exciting. That’s a mistake. Day trading magnifies every weakness—fear, greed, impatience.

You’re competing with algorithms and professionals. If your execution isn’t sharp, the market will humble you quickly.

2. Swing Trading

Swing trading holds positions from a few days to a few weeks.

Characteristics

-

Balanced pace

-

Less screen addiction

-

Better for working professionals

This is where most consistently profitable retail traders end up. You get time to think. Time to plan. Time to breathe.

I personally find swing trading more forgiving. It rewards patience over reflexes.

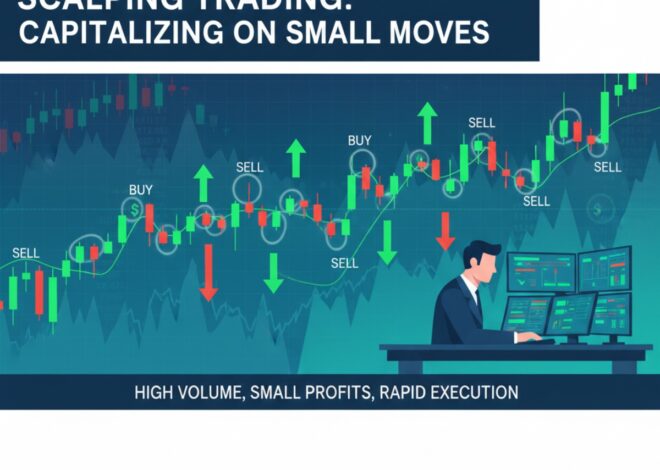

3. Scalping

Scalping focuses on very small price moves, executed many times a day.

Characteristics

-

High trade frequency

-

Tight stops

-

Requires fast execution

This style leaves zero room for hesitation. One emotional mistake wipes out ten good trades. Not beginner-friendly. Not romantic either.

4. Position Trading

Position trading is long-term trading based on macro trends.

Characteristics

-

Trades last months

-

Low stress

-

Strong conviction required

This is old-school. Less noise. Fewer decisions. But you need patience and the ability to sit through drawdowns.

Markets & Instruments (Where Trading Actually Happens)

Trading exists across multiple markets. The mistake beginners make? Trying all of them at once.

Stock Market

-

Shares of publicly listed companies

-

Regulated exchanges

-

Lower volatility compared to crypto

Stocks are slower but cleaner. Great place to understand price behavior.

Forex Market

-

Currency pairs like EUR/USD

-

Massive liquidity

-

Operates 24 hours

Forex looks calm but leverage makes it dangerous. Small moves can create big losses if mismanaged.

Crypto Market

-

Highly volatile

-

Emotion-driven

-

News-sensitive

Crypto teaches risk management the hard way. Great learning ground if you survive.

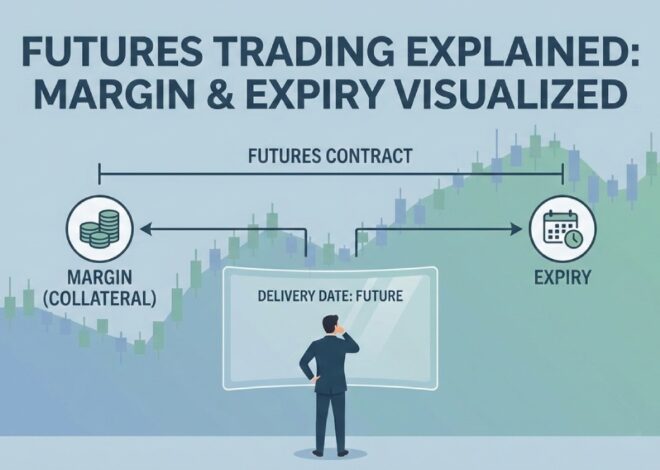

Derivatives (Futures & Options)

-

Contracts, not assets

-

Leverage-heavy

-

Time-sensitive

Options trading scares people—and rightly so. Used properly, it’s a risk-defined tool. Used emotionally, it’s financial self-harm.

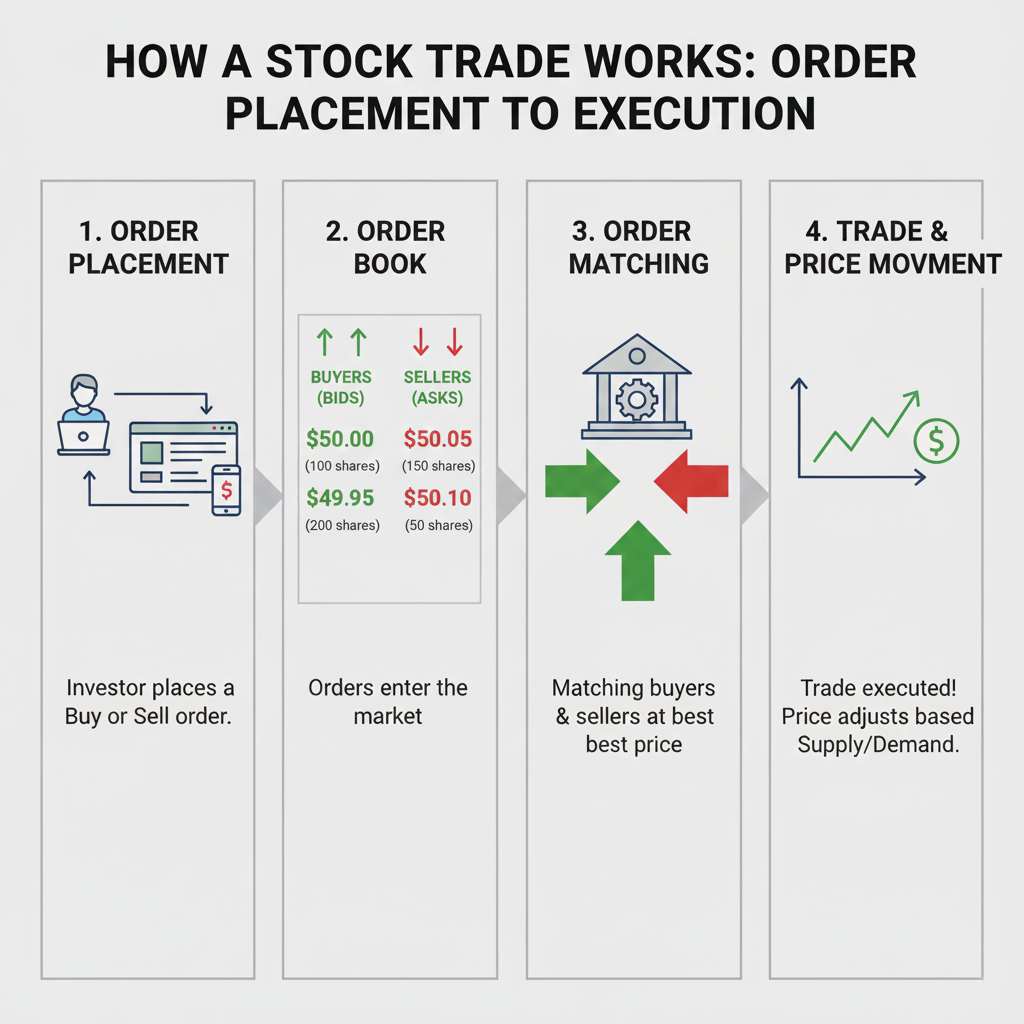

How Trading Works (The Engine Behind Every Trade)

Most people trade charts. Few understand the mechanism.

Here’s what actually happens:

-

Buyers and sellers place orders

-

Orders sit in an order book

-

Price moves when imbalance occurs

-

Institutions drive volume

-

Retail traders react

Price is not random. It moves because someone bigger is positioning capital.

Understanding this changes how you see charts. Candles stop looking magical. They start looking logical.

Accounts, Tools & Setup (What You Actually Need)

Trading Account

Choose brokers based on:

-

Regulation

-

Execution quality

-

Platform stability

Avoid brokers promising bonuses. Real brokers don’t need gimmicks.

Essential Tools

-

Charting software

-

Order placement platform

-

Journal for tracking trades

From what I’ve seen, people obsess over indicators but ignore journaling. That’s like lifting weights without tracking progress.

Trading Strategies (Why Random Trades Fail)

A strategy is simply rules for entering and exiting trades.

No rules = gambling.

Trend Following Strategy

-

Trade with market direction

-

Uses moving averages or structure

This strategy survives decades because it aligns with how markets move.

Range Trading Strategy

-

Buy near support

-

Sell near resistance

Works best when markets slow down. Requires patience and discipline.

Breakout Strategy

-

Trade expansion after consolidation

-

High reward

-

Many false signals

Only works with proper risk management.

Strategies don’t stop working. People stop following them.

Technical Analysis (Reading Market Psychology)

It’s not prediction.

It’s probability assessment.

Core Elements

Support & Resistance

Areas where buyers or sellers previously dominated.

Trend Structure

Higher highs and higher lows matter more than indicators.

Volume

Confirms strength or weakness.

I’ve noticed traders stacking indicators while ignoring price structure. That’s backwards. Price leads. Indicators follow.

Risk Management (Why Survival Beats Profit)

This section decides your future.

The Truth About Risk

You don’t control outcomes.

You control loss size.

Non-Negotiable Rules

-

Risk 1–2% per trade

-

Always use stop-loss

-

No revenge trading

Blowing accounts isn’t bad luck. It’s bad risk control.

Trading Psychology (The Hardest Skill)

This is where traders break.

Psychological Traps

-

Fear of missing out

-

Overconfidence after wins

-

Hesitation after losses

-

Emotional attachment to trades

From experience, the market punishes emotional behavior immediately. No mercy.

Consistency comes when emotions stop controlling execution.

Who Should Trade (And Who Should Walk Away)

Many beginners fail not because trading is hard, but because they choose trading styles that do not match their personality or lifestyle.

Trading Fits People Who:

-

Can follow rules

-

Accept losses calmly

-

Think long-term

Trading Destroys People Who:

-

Chase excitement

-

Need instant validation

-

Hate structure

Be honest. Trading doesn’t care about motivation.

Micro Queries

How much money needed for trading?

You can start small. But learning properly requires capital you can lose without stress. Under-capitalization creates emotional pressure.

Can beginners start trading?

Yes. But start slow. Paper trade. Learn execution before risking money.

Best trading type for beginners?

Swing trading. It slows things down and reduces emotional mistakes.

Trading mistakes beginners make

-

Overtrading

-

Ignoring stop-loss

-

Following tips

-

Increasing size after wins

Classic errors. Repeated daily.

Can you lose all money in trading?

Yes. Especially with leverage and no risk rules.

Why most traders fail?

Unrealistic expectations and lack of discipline. Not intelligence.

Is options trading dangerous?

Options are tools. Misuse is dangerous. Education matters.

How long to become profitable trader?

Realistically, 1–3 years of focused learning and journaling.

FAQs

1. Is trading better than investing?

Different goals. Trading focuses on price. Investing focuses on value.

2. Can trading be full-time?

Yes. But only after consistency. Not before.

3. Do indicators guarantee profits?

No. They assist decision-making only.

4. Is news important?

Yes, but price reacts before headlines.

5. Should beginners trade multiple markets?

No. Master one market first.

6. Is leverage always bad?

No. It’s neutral. Misuse makes it lethal.

7. Can trading be automated?

Yes. But systems still need human discipline.

8. Should I learn fundamentals or technicals first?

Technicals first. Fundamentals add context later.

Final Reality Check

Trading rewards discipline.

Punishes ego.

And exposes character.

Old rules still win:

-

Protect capital

-

Respect risk

-

Stay consistent

New tools help. They don’t replace responsibility.

If you treat trading like a business, it may pay you like one.

If you treat it like entertainment, it will invoice you—daily.

No hype. No illusions. Just the truth.