Mortgage: The Simple Truth Behind the Loan Everyone Talks About

Ever notice how the word mortgage shows up everywhere — adulting videos, family chats, even random finance memes? Yeah, same here. For something so common, it still freaks people out. But once you strip away the jargon, a mortgage is just a long-term promise backed by a house. Nothing mystical.

Let’s break it down like a friend explaining it over chai — straight, simple, but with all the real talk intact.

The Real Deal About Mortgage

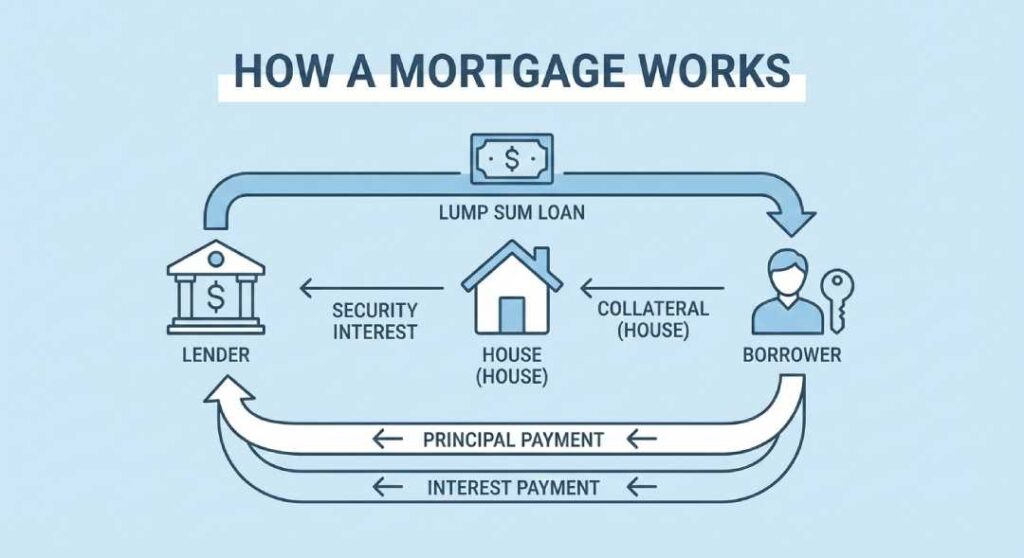

A mortgage is basically a loan where the house you’re buying acts as the collateral. You miss payments? The lender can legally take the home — that’s foreclosure. It sounds harsh, but that’s the trade-off: because the loan is secured, lenders trust you with bigger amounts and better interest rates.

What I find interesting is how this setup hasn’t changed much over decades. People have always borrowed to buy land or property — mortgages just made the process cleaner and more structured.

Why Mortgage Exists (And Why Everyone Searches for It)

People look up “mortgage” because it’s one of the biggest financial decisions anyone makes. Buying a home isn’t like buying a new phone — you can’t return it if you regret it.

A mortgage smooths the journey. Instead of dropping ₹1 crore upfront (lol, who’s doing that casually?), you split it into manageable monthly payments over 15 or 30 years. That’s why it exists: to make homeownership reachable for normal humans.

Plus, info online is a mess. People want clarity. They want to know:

-

What type of mortgage fits them

-

How interest works

-

What traps to avoid

-

How not to lose their house

Totally fair questions, honestly.

How a Mortgage Actually Works (Minus the Complication)

1. It’s a Secured Loan

The house is the security. If you default, the bank steps in. That’s why interest rates can be lower compared to unsecured loans.

2. You Pay Principal + Interest

Every month, you chip away at:

-

The principal → the actual amount you borrowed

-

The interest → the bank’s fee for lending

Sometimes taxes and insurance get bundled in too.

3. Loan Term Matters

Most people pick:

-

15-year mortgage → higher monthly payment, lower total interest

-

30-year mortgage → smaller monthly payment, more interest over time

From my experience, people with stable income but less upfront cash usually go for the 30-year option.

4. It’s a Deal Between Borrower and Lender

The lender gives funds.

You promise to repay.

The home stands as the safety net for both sides.

Different Types of Mortgage You’ll Hear About

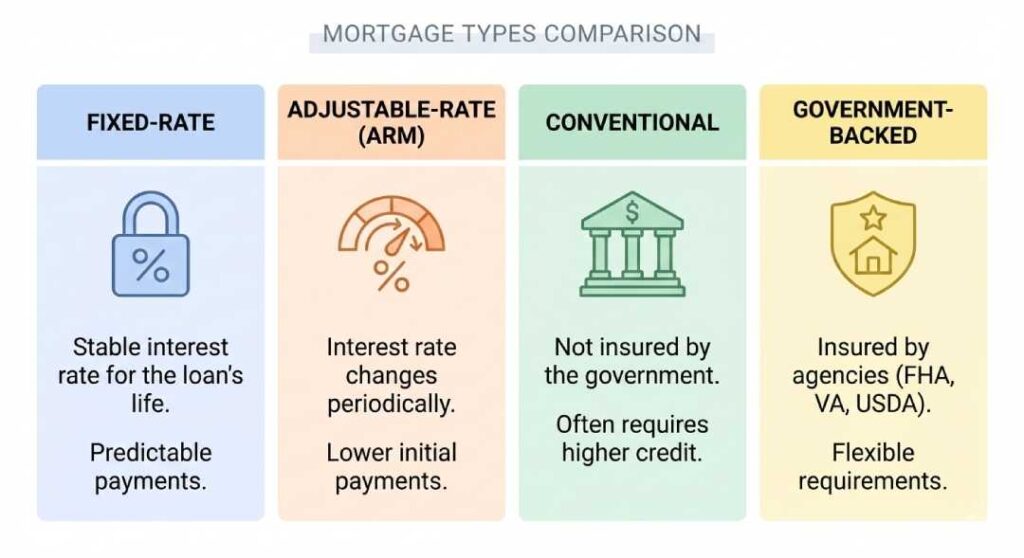

Fixed-Rate Mortgage

Your interest stays the same year after year. No surprises, no drama.

Adjustable-Rate Mortgage (ARM)

Starts stable. Then adjusts based on the market. Can go low or high — a bit of a gamble if you ask me.

Conventional Mortgage

Private lenders. No government backing. You need decent credit and a down payment.

Government-Insured Loans

FHA, VA, and similar types. Designed to help borrowers with lower credit or military backgrounds.

A real-world comparison?

Think of mortgages like phone plans.

Fixed-rate is prepaid: predictable, simple.

ARM is postpaid: flexible but risky if you don’t track usage.

You might love this article: What Are Mortgage Rates

Why You Should Care About Mortgage

Because a mortgage can shape your next 20–30 years. It impacts your savings, lifestyle, even the job decisions you make. Mess it up, and you’re stressed for months. Nail it, and you calmly build wealth while living in your own space.

And honestly, owning a home hits different. It’s stability in a world that keeps spinning faster every year.

Real Alternatives / Real Facts About Mortgage

If the typical mortgage doesn’t vibe with your situation, people explore:

-

Renting → flexible, no long-term debt

-

Owner financing → pay the seller directly

-

Co-buying → splitting cost with family or a partner

-

Living smaller → tiny homes, cheaper areas

Another fact people forget: You can refinance your mortgage later for lower interest. Plenty of people do this once they get better income or credit.

Lessons Behind Mortgage (The Stuff People Wish They Knew Sooner)

-

Your interest rate controls more of your cost than you think.

-

A lower monthly payment isn’t always “better.”

-

The mortgage that works for your friend may wreck your finances.

-

Banks don’t care about emotions — it’s math for them.

-

You must check the fine print. Always.

From my own observations, people stress more about choosing a mortgage than maintaining it. But once payments start, the routine becomes manageable.

Red Flags to Watch For in a Mortgage

-

Too-good-to-be-true promotional rates

-

Adjustable rates without clear terms

-

Prepayment penalties

-

High closing costs hidden in the paperwork

-

Pressure from agents or brokers to rush

If something feels off, it usually is. Trust your instincts — and double-check the numbers.

Wrapping Up Mortgage

A mortgage isn’t scary once you understand the moving parts. It’s just a long-term financial tool that helps you buy a home. The key is choosing the right type, understanding the payments, and keeping an eye on interest rates. When done right, it becomes the backbone of smart homeownership.

FAQs About Mortgage

1. What’s the purpose of a mortgage?

To help people buy property without paying the full amount upfront.

2. Is a fixed-rate mortgage better than an ARM?

If you hate surprises, yes. If you’re okay with risk for potential savings, an ARM works.

3. How much down payment do I need?

Typically 10–20%, but some government-backed loans allow less.

4. Can I pay off a mortgage early?

Yes, unless your lender charges prepayment penalties. Always ask first.

5. What happens if I miss payments?

Late fees, credit damage, and eventually foreclosure if ignored.